3.1: A Framework for Development

- Page ID

- 6811

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)A Framework for Development

What are the keys to economic development? Clearly, each nation’s experience is unique; we cannot isolate the sources of development success in a laboratory. We can, however, identify some factors that appear to have played an important role in successful economic development. We will look separately at policies that relate to the domestic economy and at policies in international trade.

Universal Generalizations

- Economists believe that there are several ways for a country to achieve economic growth.

- There is not a particular path to take for a country to achieve economic growth or become a developed nation.

Guiding Questions

- What is the nature of economic development?

- What are the stages of economic development?

- How can industrialized nations help developing countries?

- What has the World Bank recommended for developing countries?

Domestic Policy and Economic Development

Which domestic policies contribute to development? Looking at successful economies, those that have achieved high and sustained increases in per capita output, we can see some clear tendencies. They include a market economy, a high saving rate, and investment in infrastructure and in human capital.

Market Economies and Development

There can be no clearer lesson than that a market-oriented economy is a necessary condition for economic development. We saw in the chapter that introduced the production possibilities model that economic systems can be categorized as market capitalist, command socialist, or as mixed economic systems. There are no examples of development success among command socialist systems, although some people still believe that the former Soviet Union experienced some development advances in its early years.

One of the most dramatic examples is provided by China. Its shift in the late 1970s to a more market-based economy has ushered in a period of phenomenal growth. China, which has shifted from a command socialist to what could most nearly be categorized as a mixed economy, has been among the fastest-growing economies in the world for the past 20 years. Its growth has catapulted China from being one of the world’s poorest countries a few decades ago to being a middle-income country today.

The experience of other economies reinforces the general observation that markets matter. South Korea, Hong Kong, Taiwan, Singapore, and Chile—all have achieved gigantic gains with a market-based approach to economic growth.

Video: Singapore's Economic Success

We should not conclude, however, that growth has been independent of any public sector activity. China, for example, remains a nominally socialist state; its government continues to play a major role. The governments of South Korea, Taiwan, and Singapore all targeted specific sectors for growth and provided government help to those sectors. Even Hong Kong, which became part of China in 1997, has a high degree of government involvement in the provision of housing, healthcare, and education. A market economy is not a non-government economy, but those countries that have left the task of resource allocation primarily to the market have achieved dramatic gains. Hong Kong and Singapore, in fact, are now included in the World Bank’s list of high-income economies.

The Rule of Law and Development

If a market is to thrive, individuals must be secure in their property. If crime or government corruption makes it likely that individuals will regularly be subjected to a loss of property, then exchange will be difficult and little investment will occur. Also, the rule of law is necessary for contracts; that is, the rule of law is necessary to provide an institutional framework in which an economy can operate.

We will see in the chapter on socialist economies in transition, for example, that Russia’s effort to achieve economic development through the adoption of a market economy has been hampered by widespread lawlessness. An important difficulty of economies with extensive regulation is that the power they grant to government officials inevitably results in widespread corruption that saps entrepreneurial effort and economic growth.

Investment and Saving

Saving is a key to growth and the achievement of high incomes. All other things considered equal, higher saving allows more resources to be devoted to increases in physical and human capital and to technological improvement. In other words, saving, which is income not spent on consumption, promotes economic growth by making available resources that can be channeled into growth-enhancing uses.

High saving rates generally accompany high levels of investment. The productivity of this investment, however, can be quite variable. Government efforts to invest in human capital by promoting education, for example, may or may not be successful in actually achieving education. Development projects sponsored by international relief agencies may or may not foster development.

However, investment in infrastructure, such as transportation and communication, clearly plays an important role in economic development. Investment in improved infrastructure facilitates the exchange of goods and services and thus fosters development.

International Economic Issues in Development

In 1974, the poorest nations among the developing nations introduced into the United Nations a Declaration on the Establishment of a New International Economic Order. The program called upon the rich nations to help them reduce the growing gap in real per capita income levels between the developed and developing nations. The declaration has come to be known as the New International Economic Order or NIEO for short.

NIEO called for different and special treatment of the developing nations in the international arena in areas such as trade policy and control over multinational corporations. NIEO reflected a widely held view of international relations known as dependency theory.

Dependency Theory and Trade Policy

Conventional economic theory concerning international trade is based on the idea of comparative advantage. As we have seen in other chapters, the principle of comparative advantage suggests that free trade between two countries will benefit both and, in general, the freer the trade, the better. But some economists have proposed a doctrine that challenges this idea. Dependency theory concludes that poverty in developing nations is the result of their dependence on high-income nations.

Dependency theory holds that the industrialized nations control the destiny of the developing nations, particularly in terms of being the ultimate markets for their exports, serving as the source of capital required for development, and controlling the relative prices and exchange rates at which market transactions occur. In addition, export industries in a developing nation are assumed to have small multiplier effects throughout the rest of the economy, severely limiting any positive role than an expanded export sector might play. Specifically, limited transportation, a poorly developed financial sector, and an uneducated workforce stand in the way of “multiplying” any positive effects of export expansion. A poor country thus may not experience the kind of development and growth enjoyed by the rich country pursuing free trade. Also, increased trade makes the poor country more dependent on the rich country and its export service firms. In short, the benefits of trade between a rich country and a poor country will go almost entirely to the rich country.

The development strategy that this line of argument suggests is that developing countries would need to become independent of the already developed nations in order to achieve economic development. In relative terms, free trade would leave the poor country poorer and the rich country richer. Some dependency theorists even argue that trade is likely to make poor countries poorer in absolute terms.

Tanzania’s president, Julius Nyerere, speaking before the United Nations in 1975, put it bluntly, “I am poor because you are rich.”

Import Substitution Strategies and Export-Led Development

If free trade widens the gap between rich and poor nations and makes poor nations poorer, it follows that a poor country should avoid free trade. Many developing countries, particularly in Latin America, attempted to overcome the implications of dependency theory by adopting a strategy of import substitution, a strategy of blocking most imports and substituting domestic production of those goods.

The import substitution strategy calls for rapidly increasing industrialization by mimicking the already industrialized nations. The intent is to reduce the dependence of the developing country on imports of consumer and capital goods from the industrialized countries by manufacturing these goods at home. But in order to protect these relatively high-cost industries at home, the developing country must establish very high protective tariffs. Moreover, the types of industries that produce the previously imported consumer goods and capital goods are unlikely to increase the demand for unskilled labor. Yet unskilled labor is the most abundant resource in poor countries. Adopting the import substitution strategy raises the demand for expensive capital, managerial talent, and skilled labor—resources in short supply.

High tariffs insulate domestic firms from competition, but that tends to increase their monopoly power. Recognizing that some imported goods, particularly spare parts for industrial equipment, will be needed, countries can establish complex permit systems through which firms can import vital parts and other equipment. But that leaves a company’s fortunes in the hands of the government bureaucrats issuing the permits. A highly corrupt system quickly evolves in which a few firms bribe their way to easy access to foreign markets, reducing competition still further. Instead of the jobs expected to result from import substitution, countries implementing the import substitution strategy get the high prices, reduced production, and poor quality that come from reduced competition.

No country that has relied on a general strategy of import substitution has been successful in its development efforts. It is an idea whose time has not come. In contrast, more successful economies in Asia and elsewhere have kept their economies fairly open to both imports and exports. They have shown the greatest ability to move the development process along.

Development and International Financial Markets

Successful development in the developing nations requires more than just redirecting labor and capital resources into newly emerging sectors of the economy. That could be accomplished by both domestic firms and international firms located within the economy. To complement the reorientation of traditional production processes, economic infrastructures such as roads, schools, communication facilities, ports, warehouses, and many other prerequisites to growth must be put into place. Paying for the projects requires a high level of saving.

The sources of saving are private saving, government saving, and foreign saving. Grants in the form of foreign aid from the developed nations supplement these sources, but they form a relatively small part of the total.

Private domestic saving is an important source of funds. However, even high rates of private saving cannot guarantee sufficient funds in a poor economy where the bulk of the population lives close to the subsistence level. Government saving in the form of tax revenues in excess of government expenditures is almost universally negative. If the required investments are to take place, the developing nations have to borrow the money from foreign savers.

The problem for developing nations borrowing funds from foreigners is the same potential difficulty any borrower faces: the debt can be difficult to repay. Unlike, say, the national debt of the United States government, whose obligations are in its own currency, developing nations typically commit to make loan payments in the currency of the lending institution. Money borrowed by Brazil from a U.S. bank, for example, must generally be paid back in U.S. dollars.

Many developing nations borrowed heavily during the 1970s, only to find themselves in trouble in the 1980s. Countries such as Brazil suspended payments on their debt when required payments exceeded net exports. Much foreign debt was simply written off as bad debt by lending institutions. While foreign debts created a major crisis in the 1980s, subsequent growth appeared to make these payments more manageable.

A somewhat different international financial crisis emerged in the late 1990s. It started in Thailand in the summer of 1997. Thailand had experienced 20 years of impressive economic growth and rising living standards. One element of its development strategy was to maintain a fixed exchange rate between its currency, the baht, and the dollar. The slowing of Japanese growth, which reduced demand for Thai exports, and weaknesses in the Thai banking sector were putting downward pressure on the baht, which Thailand’s central bank initially tried to counteract. As discussed there, this effort was abandoned, and the value of the currency declined.

In an effort to keep its exchange rate somewhat stable, the Thai government appealed to the International Monetary Fund (IMF) for support. The IMF is an international agency that makes financial assistance available to member countries experiencing problems in their international balance of payments in order to support adjustment and reform in those countries. In an agreement between Thailand and the IMF, Thailand’s central bank tightened monetary policy, thereby raising interest rates there. The logic behind this move was that higher interest rates in Thailand would make the baht more attractive to both Thai and foreign financial investors, who could thus earn more on Thai bonds and on other Thai financial assets. This would increase the demand for baht and help to keep the currency from falling further. Thailand also agreed to tighten fiscal policy, the rationale for which was to prepare for the anticipated future costs of restructuring its banking system. As we have learned throughout macroeconomics, however, contractionary monetary and fiscal policies will reduce real GDP in the short run. The hope was that growth would resume once the immediate currency crisis was over and plans had been put into place for correcting other imbalances in the Thai economy.

Other countries, such as South Korea and Brazil, soon experienced similar currency disturbances and entered into similar IMF programs to put their domestic houses in order in exchange for financial assistance from the IMF. For some of the other countries that went through similar experiences, notably Indonesia and Malaysia, the situation in 1999 was very unstable. Malaysia decided to forgo IMF assistance and to impose massive currency controls. In Indonesia, the financial crisis and the ensuing economic crisis led to political unrest. It held its first free elections in June 1999, but violence erupted in late 1999, when the overwhelming majority of people in East Timor voted against an Indonesian proposal that the province have limited autonomy within Indonesia and voted for independence from Indonesia.

Remarkably, in the early 2000s, the economies of most of these countries rebounded, although they are now caught up in the global economic downturn.

Development Successes

As we have seen throughout this chapter, the greatest success stories are found among the newly industrializing economies (NIEs) in East Asia. These economies, including Hong Kong, South Korea, Singapore, and Taiwan, share two common traits. First, they have allowed their economies to develop through an emphasis on export-based, market capitalist strategies. The NIEs achieved higher per capita income and output by entering and competing in the global market for products such as computers, automobiles, plastics, chemicals, steel, shipbuilding, and sporting goods. These countries have succeeded largely by linking standardized production technologies with low-cost labor.

Second, the role of government was relatively limited in the NIEs, which made less use of regulation and bureaucratic controls. Governments were clearly involved in some strategic industries, and, in the wake of recent financial crises, in some cases it appears that this involvement led to some decisions in those industries being made on political rather than on economic grounds. The principal contribution of governments in the Far Eastern NIEs has been to create a modern infrastructure (especially up-to-date communications facilities essential for the development of a strong financial sector), to provide a stable incentive system (including stable exchange rates), and to ensure that government bureaucracy will help rather than hinder exports (especially by not regulating export trade, labor markets, and capital markets).Bela Balassa, “The Lessons of East Asian Development,” Economic Development and Cultural Change 36, no. 3 (April 1988): S247–S290.

Chile adopted sweeping market reforms in the late 1970s, creating the most free economy in Latin America. Chile’s growth has accelerated sharply, and the country has moved to the upper-middle-income group of nations. Perhaps more dramatic, the dictator who instituted market reforms, General Augusto Pinochet, agreed to democratic elections that removed him from power in 1989. Chile now has a greatly increased degree of political as well as economic freedom—and has emerged as the most prosperous country in Latin America.

Over the last decade, Mexico also shifted from a strategy of import substitution and began to follow more free-trade-oriented policies. The North American Free Trade Agreement (NAFTA) turned all of North America into a free trade zone. This could not have occurred had Mexico not undergone such a dramatic shift in its development strategy. Mexico’s commitment to the new strategy was tested in 1994 when the country underwent a currency crisis similar to that experienced in many Asian countries in 1997 and 1998. At that time, Mexico, too, entered into an agreement with the IMF to address economic imbalances in return for financial assistance. The U.S. government also provided support to help Mexico at that time. By 1996, the Mexican economy was growing again, and Mexican commitment to more open policies has endured. Only with the passage of time will we know for sure whether the changed strategy worked in Mexico as well, but the early signs are that it is working.

Although the trend in developing countries toward market reforms has been less heralded than the collapse of communism, it is surely significant. Will market reforms translate into development success? The jury is still out. Market reform requires that many wealthy—and powerful—interests be swept aside. Whether that can be achieved, and whether poor people who lack human capital can be included in the development effort, remain open questions. Some dramatic success stories have shown that economic development can be achieved. The fate of billions of desperately poor people rests in the ability of their countries to match that success.

Components of Economic Growth

Over decades and generations, seemingly small differences of a few percentage points in the annual rate of economic growth make an enormous difference in GDP per capita. In this module, we discuss some of the components of economic growth, including physical capital, human capital, and technology.

The category of physical capital includes the plant and equipment used by firms and also things like roads (also called infrastructure). Again, greater physical capital implies more output. Physical capital can affect productivity in two ways: (1) an increase in the quantity of physical capital (for example, more computers of the same quality); and (2) an increase in the quality of physical capital (same number of computers but the computers are faster, and so on). Human capital and physical capital accumulation are similar: In both cases, investment now pays off in longer-term productivity in the future.

The category of technology is the “joker in the deck.” Earlier we described it as the combination of invention and innovation. When most people think of new technology, the invention of new products like the laser, the smartphone, or some new wonder drug come to mind. In food production, the development of more drought-resistant seeds is another example of technology. Technology, as economists use the term, however, includes still more. It includes new ways of organizing work, like the invention of the assembly line, new methods for ensuring better quality of output in factories, and innovative institutions that facilitate the process of converting inputs into output. In short, technology comprises all the advances that make the existing machines and other inputs produce more, and at higher quality, as well as altogether new products.

It may not make sense to compare the GDPs of China and say, Benin, simply because of the great difference in population size. To understand economic growth, which is really concerned with the growth in living standards of an average person, it is often useful to focus on GDP per capita. Using GDP per capita also makes it easier to compare countries with smaller numbers of people, like Belgium, Uruguay, or Zimbabwe, with countries that have larger populations, like the United States, the Russian Federation, or Nigeria.

To obtain a per capita production function, divide each input in (a) by the population. This creates a second aggregate production function where the output is GDP per capita (that is, GDP divided by population). The inputs are the average level of human capital per person, the average level of physical capital per person, and the level of technology per person (b). The result of having population in the denominator is mathematically appealing. Increases in population lower per capita income. However, increasing population is important for the average person only if the rate of income growth exceeds population growth. A more important reason for constructing a per capita production function is to understand the contribution of human and physical capital.

Capital Deepening

When society increases the level of capital per person, the result is called capital deepening. The idea of capital deepening can apply both to additional human capital per worker and to additional physical capital per worker.

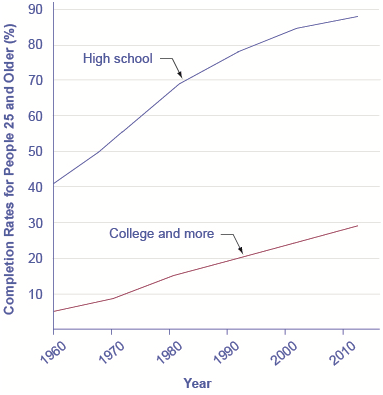

Recall that one way to measure human capital is to look at the average levels of education in an economy. Figure 1 illustrates the human capital deepening for U.S. workers by showing that the proportion of the U.S. population with a high school and a college degree is rising. As recently as 1970, for example, only about half of U.S. adults had at least a high school diploma; by the start of the twenty-first century, more than 80% of adults had graduated from high school. The idea of human capital deepening also applies to the years of experience that workers have, but the average experience level of U.S. workers has not changed much in recent decades. Thus, the key dimension for deepening human capital in the U.S. economy focuses more on additional education and training than on a higher average level of work experience.

Human Capital Deepening in the U.S.

Rising levels of education for persons 25 and older show the deepening of human capital in the U.S. economy. Even today, relatively few U.S. adults have completed a four-year college degree. There is clearly room for additional deepening of human capital to occur. (Source: US Department of Education, National Center for Education Statistics)

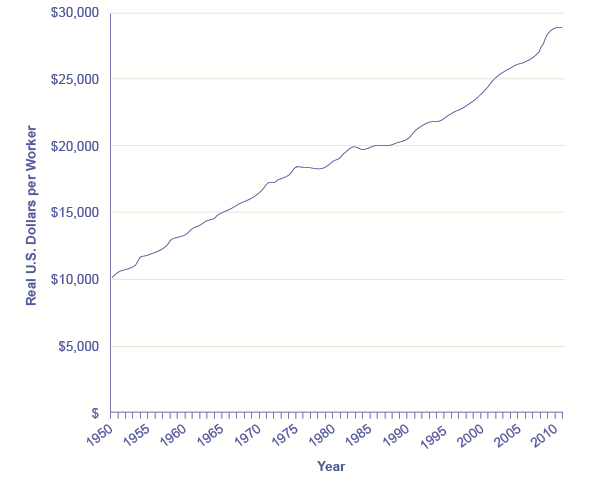

Physical capital deepening in the U.S. economy is shown in Figure 2. The average U.S. worker in the late 2000s was working with physical capital worth almost three times as much as that of the average worker of the early 1950s.

Physical Capital per Worker in the United States

The value of the physical capital, measured by plant and equipment, used by the average worker in the U.S. economy has risen over the decades. The increase may have leveled off a bit in the 1970s and 1980s, which were not, coincidentally, times of slower-than-usual growth in worker productivity. We see a renewed increase in physical capital per worker in the late 1990s, followed by a flattening in the early 2000s. (Source: Center for International Comparisons of Production, Income and Prices, University of Pennsylvania)

Not only does the current U.S. economy have better-educated workers with more and improved physical capital than it did several decades ago, but also these workers have access to more advanced technologies. Growth in technology is impossible to measure with a simple line on a graph, but evidence that we live in an age of technological marvels is all around us—discoveries in genetics and in the structure of particles, the wireless Internet, and other inventions almost too numerous to count. The U.S. Patent and Trademark Office typically has issued more than 150,000 patents annually in recent years.

This recipe for economic growth—investing in labor productivity, with investments in human capital and technology, as well as increasing physical capital—also applies to other economies. In South Korea, for example, universal enrollment in primary school (the equivalent of kindergarten through sixth grade in the United States) had already been achieved by 1965, when Korea’s GDP per capita was still near its rock bottom low. By the late 1980s, Korea had achieved almost universal secondary school education (the equivalent of a high school education in the United States). With regard to physical capital, Korea’s rates of investment had been about 15% of GDP at the start of the 1960s, but doubled to 30–35% of GDP by the late 1960s and early 1970s. With regard to technology, South Korean students went to universities and colleges around the world to get scientific and technical training, and South Korean firms reached out to study and form partnerships with firms that could offer them technological insights. These factors combined to foster South Korea’s high rate of economic growth.

Growth Accounting Studies

Since the late 1950s, economists have conducted growth accounting studies to determine the extent to which physical and human capital deepening and technology have contributed to growth. The usual approach uses an aggregate production function to estimate how much of per capita economic growth can be attributed to growth in physical capital and human capital. These two inputs can be measured, at least roughly. The part of growth that is unexplained by measured inputs, called the residual, is then attributed to growth in technology. The exact numerical estimates differ from study to study and from country to country, depending on how researchers measured these three main factors over what time horizons. For studies of the U.S. economy, three lessons commonly emerge from growth accounting studies.

First, technology is typically the most important contributor to U.S. economic growth. Growth in human capital and physical capital often explains only half or less than half of the economic growth that occurs. New ways of doing things are tremendously important.

Second, while investment in physical capital is essential to growth in labor productivity and GDP per capita, building human capital is at least as important. Economic growth is not just a matter of more machines and buildings. One vivid example of the power of human capital and technological knowledge occurred in Europe in the years after World War II (1939–1945). During the war, a large share of Europe’s physical capital, such as factories, roads, and vehicles, was destroyed. Europe also lost an overwhelming amount of human capital in the form of millions of men, women, and children who died during the war. However, the powerful combination of skilled workers and technological knowledge, working within a market-oriented economic framework, rebuilt Europe’s productive capacity to an even higher level within less than two decades.

A third lesson is that these three factors of human capital, physical capital, and technology work together. Workers with a higher level of education and skills are often better at coming up with new technological innovations. These technological innovations are often ideas that cannot increase production until they become a part of new investment in physical capital. New machines that embody technological innovations often require additional training, which builds worker skills further. If the recipe for economic growth is to succeed, an economy needs all the ingredients of the aggregate production function. See the following Clear It Up feature for an example of how human capital, physical capital, and technology can combine to significantly impact lives.

Video: Celebrating International Day of the Girl

How Do Girls' Education and Economic Growth Relate in Low-Income Countries?

In the early 2000s, according to the World Bank, about 110 million children between the ages of 6 and 11 were not in school—and about two-thirds of them were girls. In Bangladesh, for example, the illiteracy rate for those aged 15 to 24 was 78% for females, compared to 75% for males. In Egypt, for this age group, illiteracy was 84% for females and 91% for males. Cambodia had 86% illiteracy for females and 88% for males. Nigeria had 66% illiteracy for females in the 15 to 24 age bracket and 78% for males.

Whenever any child does not receive a basic education, it is both a human and an economic loss. In low-income countries, wages typically increase by an average of 10 to 20% with each additional year of education. There is, however, some intriguing evidence that helping girls in low-income countries to close the education gap with boys may be especially important, because of the social role that many of the girls will play as mothers and homemakers.

Girls in low-income countries who receive more education tend to grow up to have fewer, healthier, better-educated children. Their children are more likely to be better nourished and to receive basic health care such as immunizations. Economic research on women in low-income economies backs up these findings. When 20 women get one additional year of schooling, as a group they will, on average, have one less child. When 1,000 women get one additional year of schooling, on average one to two fewer women from that group will die in childbirth. When a woman stays in school an additional year, that factor alone means that, on average, each of her children will spend an additional half-year in school. Education for girls is a good investment because it is an investment in economic growth with benefits beyond the current generation.

A Healthy Climate for Economic Growth

While physical and human capital deepening and better technology are important, equally important to a nation’s well-being is the climate or system within which these inputs are cultivated. Both the type of market economy and a legal system that governs and sustains property rights and contractual rights are important contributors to a healthy economic climate.

A healthy economic climate usually involves some sort of market orientation at the microeconomic, individual, or firm decision-making level. Markets that allow personal and business rewards and incentives for increasing human and physical capital encourage overall macroeconomic growth. For example, when workers participate in a competitive and well-functioning labor market, they have an incentive to acquire additional human capital, because additional education and skills will pay off in higher wages. Firms have an incentive to invest in physical capital and in training workers because they expect to earn higher profits for their shareholders. Both individuals and firms look for new technologies because even small inventions can make work easier or lead to product improvement. Collectively, such individual and business decisions made within a market structure add up to macroeconomic growth. Much of the rapid growth since the late nineteenth-century has come from harnessing the power of competitive markets to allocate resources. This market orientation typically reaches beyond national borders and includes openness to international trade.

A general orientation toward markets does not rule out important roles for government. There are times when markets fail to allocate capital or technology in a manner that provides the greatest benefit for society as a whole. The role of the government is to correct these failures. In addition, the government can guide or influence markets toward certain outcomes. The following examples highlight some important areas that governments around the world have chosen to invest in to facilitate capital deepening and technology: Education. The Danish government requires all children under 16 to attend school. They can choose to attend a public school (Folkeskole) or a private school. Students do not pay tuition to attend Folkeskole. Thirteen percent of primary/secondary (elementary/high) school is private, and the government supplies vouchers to citizens who choose private school.

In the United States, as in other countries, private investment is taxed. Low capital gains taxes encourage investment and thereby economic growth. The Japanese government in the mid-1990s undertook significant infrastructure projects to improve roads and public works. This, in turn, increased the stock of physical capital and ultimately economic growth.

The island of Mauritius is one of the few African nations to encourage international trade in government-supported special economic zones (SEZ). These are areas of the country, usually with access to a port where, among other benefits, the government does not tax trade. As a result of its SEZ, Mauritius has enjoyed above-average economic growth since the 1980s. Free trade does not have to occur in an SEZ, however. Governments can encourage international trade across the board, or surrender to protectionism.

The European Union has strong programs to invest in scientific research. The researchers Abraham García and Pierre Mohnen demonstrate that firms which received support from the Austrian government actually increased their research intensity and had more sales. Governments can support scientific research and technical training that helps to create and spread new technologies. Governments can also provide a legal environment that protects the ability of inventors to profit from their inventions.

There are many more ways in which the government can play an active role in promoting economic growth. A healthy climate for growth in GDP per capita and labor productivity includes human capital deepening, physical capital deepening, and technological gains, operating in a market-oriented economy with supportive government policies.

Over decades and generations, seemingly small differences of a few percentage points in the annual rate of economic growth make an enormous difference in GDP per capita. Capital deepening refers to an increase in the amount of capital per worker, either human capital per worker, in the form of higher education or skills, or physical capital per worker. Technology, in its economic meaning, refers broadly to all new methods of production, which includes major scientific inventions and also small inventions and even better forms of management or other types of institutions. A healthy climate for growth in GDP per capita consists of improvements in human capital, physical capital, and technology, in a market-oriented environment with supportive public policies and institutions.

Economic Convergence

Some low-income and middle-income economies around the world have shown a pattern of convergence, in which their economies grow faster than those of high-income countries. GDP increased by an average rate of 2.7% per year in the 1990s and 2.3% per year from 2000 to 2008 in the high-income countries of the world, which include the United States, Canada, the countries of the European Union, Japan, Australia, and New Zealand.

Table 1 lists 10 countries of the world that belong to an informal “fast growth club.” These countries averaged GDP growth (after adjusting for inflation) of at least 5% per year in both the time periods from 1990 to 2000 and from 2000 to 2008. Since economic growth in these countries has exceeded the average of the world’s high-income economies, these countries may converge with the high-income countries. The second part of Table 1 lists the “slow growth club,” which consists of countries that averaged GDP growth of 2% per year or less (after adjusting for inflation) during the same time periods. The final portion of Table 1 shows GDP growth rates for the countries of the world divided by income.

Economic Growth around the World(Source: http://databank.worldbank.org/data/views/variableSelection/selectvariables.aspx?source=world-development-indicators#c_u)

| Country | Average Growth Rate of GDP 1990–2000 | Average Growth Rate of GDP 2000–2008 |

| Fast Growth Club (5% or more per year in both time periods) | ||

| Cambodia | 7.1% | 9.1% |

| China | 10.6% | 9.9% |

| India | 6.0% | 7.1% |

| Ireland | 7.5% | 5.1% |

| Jordan | 5.0% | 6.3% |

| Laos | 6.5% | 6.8 % |

| Mozambique | 6.4% | 7.3% |

| Sudan | 5.4% | 7.3% |

| Uganda | 7.1% | 7.3% |

| Vietnam | 7.9% | 7.3% |

| Slow Growth Club (2% or less per year in both time periods) | ||

| Central African Republic | 2.0% | 0.8% |

| France | 2.0% | 1.8% |

| Germany | 1.8% | 1.3% |

| Guinea-Bissau | 1.2% | 0.2% |

| Haiti | –1.5% | 0.3% |

| Italy | 1.6% | 1.2% |

| Jamaica | 0.9% | 1.4% |

| Japan | 1.3% | 1.3% |

| Switzerland | 1.0% | 2.0% |

| United States | 3.2% | 2.2% |

| World Overview | ||

| High income | 2.7% | 2.3% |

| Low income | 3.8% | 5.6% |

| Middle income | 4.7% | 6.1% |

Each of the countries in Table 1 has its own unique story of investments in human and physical capital, technological gains, market forces, government policies, and even lucky events, but an overall pattern of convergence is clear. The low-income countries have GDP growth that is faster than that of the middle-income countries, which in turn have GDP growth that is faster than that of the high-income countries. Two prominent members of the fast-growth club are China and India. Between them, they have nearly 40% of the world’s population. Some prominent members of the slow-growth club are high-income countries like the United States, France, Germany, Italy, and Japan.

Will this pattern of economic convergence persist into the future? This is a controversial question among economists that we will consider by looking at some of the main arguments on both sides.

Arguments Favoring Convergence

Several arguments suggest that low-income countries might have an advantage in achieving greater worker productivity and economic growth in the future.

A first argument is based on diminishing marginal returns. Even though deepening human and physical capital will tend to increase GDP per capita, the law of diminishing returns suggests that as an economy continues to increase its human and physical capital, the marginal gains to economic growth will diminish. For example, raising the average education level of the population by two years from a tenth-grade level to a high school diploma (while holding all other inputs constant) would produce a certain increase in output. An additional two-year increase, so that the average person had a two-year college degree, would increase output further, but the marginal gain would be smaller. Yet another additional two-year increase in the level of education, so that the average person would have a four-year-college bachelor’s degree, would increase output still further, however, the marginal increase would again be smaller. A similar lesson holds for physical capital. If the quantity of physical capital available to the average worker increases, by, say, $5,000 to $10,000 (again, while holding all other inputs constant), it will increase the level of output. An additional increase from $10,000 to $15,000 will increase output further, but the marginal increase will be smaller.

Low-income countries like China and India tend to have lower levels of human capital and physical capital, so an investment in capital deepening should have a larger marginal effect in these countries than in high-income countries where levels of human and physical capital are already relatively high. Diminishing returns implies that low-income economies could converge to the levels achieved by the high-income countries.

A second argument is that low-income countries may find it easier to improve their technologies than high-income countries. High-income countries must continually invent new technologies whereas low-income countries can often find ways of applying technology that has already been invented and is well understood. The economist Alexander Gerschenkron (1904–1978) gave this phenomenon a memorable name: “the advantages of backwardness.” Of course, he did not literally mean that it is an advantage to have a lower standard of living. He was pointing out that a country that is behind has some extra potential for catching up.

Finally, optimists argue that many countries have observed the experience of those that have grown more quickly and have learned from it. Moreover, once the people of a country begin to enjoy the benefits of a higher standard of living, they may be more likely to build and support the market-friendly institutions that will help provide this standard of living.

Arguments That Convergence Is neither Inevitable nor Likely

If the growth of an economy depended only on the deepening of human capital and physical capital, then the growth rate of that economy would be expected to slow down over the long run because of diminishing marginal returns. However, there is another crucial factor in the aggregate production function: technology.

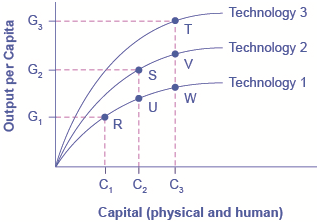

The development of new technology can provide a way for an economy to sidestep the diminishing marginal returns of capital deepening. Figure 3 shows how. The horizontal axis of the figure measures the amount of capital deepening, which on this figure is an overall measure that includes deepening of both physical and human capital. The amount of human and physical capital per worker increases as you move from left to right, from C1 to C2 to C3. The vertical axis of the diagram measures per capita output. Start by considering the lowest line in this diagram, labeled Technology 1. Along this aggregate production function, the level of technology is being held constant, so the line shows only the relationship between capital deepening and output. As capital deepens from C1 to C2 to C3 and the economy moves from R to U to W, per capita output does increase—but the way in which the line starts out steeper on the left but then flattens as it moves to the right shows the diminishing marginal returns, as additional marginal amounts of capital deepening increase output by ever-smaller amounts. The shape of the aggregate production line (Technology 1) shows that the ability of capital deepening, by itself, to generate sustained economic growth is limited, since diminishing returns will eventually set in.

Capital Deepening and New Technology

Imagine that the economy starts at point R, with the level of physical and human capital C1 and the output per capita at G1. If the economy relies only on capital deepening, while remaining at the technology level shown by the Technology 1 line, then it would face diminishing marginal returns as it moved from point R to point U to point W. However, now imagine that capital deepening is combined with improvements in technology. Then, as capital deepens from C1 to C2, technology improves from Technology 1 to Technology 2, and the economy moves from R to S. Similarly, as capital deepens from C2 to C3, technology increases from Technology 2 to Technology 3, and the economy moves from S to T. With improvements in technology, there is no longer any reason that economic growth must necessarily slow down.

Now, bring improvements in technology into the picture. Improved technology means that with a given set of inputs, more output is possible. The production function labeled Technology 1 in the figure is based on one level of technology, but Technology 2 is based on an improved level of technology, so for every level of capital deepening on the horizontal axis, it produces a higher level of output on the vertical axis. In turn, production function Technology 3 represents a still higher level of technology, so that for every level of inputs on the horizontal axis, it produces a higher level of output on the vertical axis than either of the other two aggregate production functions.

Most healthy, growing economies are deepening their human and physical capital and increasing technology at the same time. As a result, the economy can move from a choice like point R on the Technology 1 aggregate production line to a point like S on Technology 2 and a point like T on the still higher aggregate production line (Technology 3). With the combination of technology and capital deepening, the rise in GDP per capita in high-income countries does not need to fade away because of diminishing returns. The gains from technology can offset the diminishing returns involved with capital deepening.

Will technological improvements themselves run into diminishing returns over time? That is, will it become continually harder and more costly to discover new technological improvements? Perhaps someday, but, at least over the last two centuries since the Industrial Revolution, improvements in technology have not run into diminishing marginal returns. Modern inventions, like the Internet or discoveries in genetics or materials science, do not seem to provide smaller gains to output than earlier inventions like the steam engine or the railroad. One reason that technological ideas do not seem to run into diminishing returns is that the ideas of new technology can often be widely applied at a marginal cost that is very low or even zero. A specific additional machine, or an additional year of education, must be used by a specific worker or group of workers. A new technology or invention can be used by many workers across the economy at very low marginal cost.

The argument that it is easier for a low-income country to copy and adapt existing technology than it is for a high-income country to invent new technology is not necessarily true either. When it comes to adapting and using new technology, a society’s performance is not necessarily guaranteed but is the result of whether the economic, educational and public policy institutions of the country are supportive. In theory, perhaps, low-income countries have many opportunities to copy and adapt technology, but if they lack the appropriate supportive economic infrastructure and institutions, the theoretical possibility that backwardness might have certain advantages is of little practical relevance.

The Slowness of Convergence

Although economic convergence between the high-income countries and the rest of the world seems possible and even likely, it will proceed slowly. Consider, for example, a country that starts off with a GDP per capita of $40,000, which would roughly represent a typical high-income country today, and another country that starts out at $4,000, which is roughly the level in low-income but not impoverished countries like Indonesia, Guatemala, or Egypt. Say that the rich country chugs along at a 2% annual growth rate of GDP per capita, while the poorer country grows at the aggressive rate of 7% per year. After 30 years, GDP per capita in the rich country will be $72,450 (that is, $40,000 (1 + 0.02)30) while in the poor country it will be $30,450 (that is, $4,000 (1 + 0.07)30). Convergence has occurred; the rich country used to be 10 times as wealthy as the poor one, and now it is only about 2.4 times as wealthy. Even after 30 consecutive years of very rapid growth, however, people in the low-income country are still likely to feel quite poor compared to people in the rich country. Moreover, as the poor country catches up, its opportunities for catch-up growth are reduced, and its growth rate may slow down somewhat.

The slowness of convergence again illustrates that small differences in annual rates of economic growth become huge differences over time. The high-income countries have been building up their advantage in the standard of living over decades—more than a century in some cases. Even in an optimistic scenario, it will take decades for the low-income countries of the world to catch up significantly.

When countries with lower levels of GDP per capita catch up to countries with higher levels of GDP per capita, the process is called convergence. Convergence can occur even when both high- and low-income countries increase investment in the physical and human capital with the objective of growing GDP. This is because the impact of new investment in physical and human capital on a low-income country may result in huge gains as new skills or equipment are combined with the labor force. In higher-income countries, however, a level of investment equal to that of the low-income country is not likely to have as big an impact, because the more developed country most likely has high levels of capital investment. Therefore, the marginal gain from this additional investment tends to be successively less and less. Higher income countries are more likely to have diminishing returns to their investments and must continually invent new technologies; this allows lower-income economies to have a chance for convergent growth. However, many high-income economies have developed economic and political institutions that provide a healthy economic climate for an ongoing stream of technological innovations. Continuous technological innovation can counterbalance diminishing returns to investments in human and physical capital.

Video: Productivity and Growth

Answer the self check questions below to monitor your understanding of the concepts in this section.

Answer the self check questions below to monitor your understanding of the concepts in this section.Self Check Questions

- Define primitive equilibrium.

- List 4 categories of economic development.

- List the 4 priorities of developing nations.