4.10: Monetary Policy

- Page ID

- 1702

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Monetary Policy

The monetary policy of a nation affects various aspects of the economy. As the regulator of monetary policy the Fed: maintains the size of the money supply, influences the interest rates, can change the reserve requirements of banks, operates the buying and selling of government bonds, and determines margin requirements. The impact of the monetary policy can affect interest rates and the various sectors of the economy, which in turn can affect the allocation of resources such as capital and labor.

Universal Generalizations

- Federal Reserve actions tend to stabilize the economy by altering the monetary policy.

- The Fed does not hesitate to change the interest rates whenever it believes it will benefit the nation.

Guiding Questions

- What is the term for the rule which states the percentage of every deposit that is to be set aside as a legal reserve?

- What does the fractional reserve system allow the money supply to do?

- What is the open market operations?

Monetary policy is one of the Federal Reserve's most important responsibilities. Monetary policy is the Federal Reserve's decision to either expand or contract the money supply in order to influence the cost of available credit. The United States banking system has a fractional reserve system, which requires any depository institution to keep a percentage or fraction of their deposits on reserve, or set aside and not allowed to be loaned out. This system prevents the bank from lending out all of the deposits put into the bank. Why would the Federal Reserve System do this? First, it protects the bank from lending out too much money. Second, it protects those people who put their money in the bank. Finally, it can help the money supply grow.

In many respects, the Fed is the most powerful maker of economic policy in the United States. Congress can pass laws, but the president must execute them; the president can propose laws, but only Congress can pass them. The Fed, however, both sets and carries out monetary policy. Deliberations about fiscal policy can drag on for months, even years, but the Federal Open Market Committee (FOMC) can, behind closed doors, set monetary policy in a day—and see that policy implemented within hours. The Board of Governors can change the discount rate or reserve requirements at any time. The impact of the Fed’s policies on the economy can be quite dramatic. The Fed can push interest rates up or down. It can promote a recession or an expansion. It can cause the inflation rate to rise or fall. The Fed wields enormous power.

But to what ends should all this power be directed? With what tools are the Fed’s policies carried out? Which problems exist in trying to achieve the Fed’s goals? This section reviews the goals of monetary policy, the tools available to the Fed in pursuing those goals, and the way in which monetary policy affects macroeconomic variables.

Video: Monetary and Fiscal Policy

Goals of Monetary Policy

When we think of the goals of monetary policy, we naturally think of standards of macroeconomic performance that seem desirable—a low unemployment rate, a stable price level, and economic growth. It seems reasonable to conclude that the goals of monetary policy should include the maintenance of full employment, the avoidance of inflation or deflation, and the promotion of economic growth.

But these goals, each of which is desirable in itself, may conflict with one another. A monetary policy that helps to close a recessionary gap and thus promotes full employment may accelerate inflation. A monetary policy that seeks to reduce inflation may increase unemployment and weak economic growth. You might expect that in such cases, monetary authorities would receive guidance from legislation spelling out goals for the Fed to pursue and specifying what to do when achieving one goal means not achieving another. But as we shall see, that kind of guidance does not exist.

The Federal Reserve Act

When Congress established the Federal Reserve System in 1913, it said little about the policy goals the Fed should seek. The closest it came to spelling out the goals of monetary policy was in the first paragraph of the Federal Reserve Act, the legislation that created the Fed:

“An Act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, [to make loans to banks], to establish a more effective supervision of banking in the United States, and for other purposes.”

In short, nothing in the legislation creating the Fed anticipates that the institution will act to close recessionary or inflationary gaps, that it will seek to spur economic growth, or that it will strive to keep the price level steady. There is no guidance as to what the Fed should do when these goals conflict with one another.

The Employment Act of 1946

The first U.S. effort to specify macroeconomic goals came after World War II. The Great Depression of the 1930s had instilled in people a deep desire to prevent similar calamities in the future. That desire, coupled with the 1936 publication of John Maynard Keynes’s prescription for avoiding such problems through government policy (The General Theory of Employment, Interest and Money), led to the passage of the Employment Act of 1946, which declared that the federal government should “use all practical means . . . to promote maximum employment, production and purchasing power.” The act also created the Council of Economic Advisers (CEA) to advise the president on economic matters.

The Fed might be expected to be influenced by this specification of federal goals, but because it is an independent agency, it is not required to follow any particular path. Furthermore, the legislation does not suggest what should be done if the goals of achieving full employment and maximum purchasing power conflict.

The Full Employment and Balanced Growth Act of 1978

The clearest and most specific, statement of federal economic goals came in the Full Employment and Balanced Growth Act of 1978. This act, generally known as the Humphrey–Hawkins Act, specified that by 1983 the federal government should achieve an unemployment rate among adults of 3% or less, a civilian unemployment rate of 4% or less, and an inflation rate of 3% or less. Although these goals have the virtue of specificity, they offer little in terms of practical policy guidance. The last time the civilian unemployment rate in the United States fell below 4% was 1969, and the inflation rate that year was 6.2%. In 2000, the unemployment rate touched 4%, and the inflation rate that year was 3.4%, so the goals were close to being met. Except for 2007 when inflation hit 4.1%, inflation has hovered between 1.6% and 3.4% in all the other years between 1991 and 2011, so the inflation goal was met or nearly met, but unemployment fluctuated between 4.0% and 9.6% during those years.

The Humphrey-Hawkins Act requires that the chairman of the Fed’s Board of Governors report twice each year to Congress about the Fed’s monetary policy. These sessions provide an opportunity for members of the House and Senate to express their views on monetary policy.

Federal Reserve Policy and Goals

Perhaps the clearest way to see the Fed’s goals is to observe the policy choices it makes. Since 1979, following a bout of double-digit inflation, its actions have suggested that the Fed’s primary goal is to keep inflation under control. Provided that the inflation rate falls within acceptable limits, however, the Fed will also use stimulative measures to attempt to close recessionary gaps.

In 1979, the Fed, then led by Paul Volcker, launched a deliberate program of reducing the inflation rate. It stuck to that effort through the early 1980s, even in the face of a major recession. That effort achieved its goal: the annual inflation rate fell from 13.3% in 1979 to 3.8% in 1982. The cost, however, was great. Unemployment soared past 9% during the recession. With the inflation rate below 4%, the Fed shifted to a stimulative policy early in 1983.

In 1990, when the economy slipped into a recession, the Fed, with Alan Greenspan at the helm, engaged in aggressive open-market operations to stimulate the economy, despite the fact that the inflation rate had jumped to 6.1%. Much of that increase in the inflation rate, however, resulted from an oil-price boost that came in the wake of Iraq’s invasion of Kuwait that year. A jump in prices that occurs at the same time as real GDP is slumping suggests a leftward shift in short-run aggregate supply, a shift that creates a recessionary gap. Fed officials concluded that the upturn in inflation in 1990 was a temporary phenomenon and that an expansionary policy was an appropriate response to a weak economy. Once the recovery was clearly underway, the Fed shifted to a neutral policy, seeking neither to boost nor to reduce aggregate demand. Early in 1994, the Fed shifted to a contractionary policy, selling bonds to reduce the money supply and raise interest rates. Then Fed Chairman Greenspan indicated that the move was intended to head off any possible increase in inflation from its 1993 rate of 2.7%. Although the economy was still in a recessionary gap when the Fed acted, Greenspan indicated that any acceleration of the inflation rate would be unacceptable.

By March 1997 the inflation rate had fallen to 2.4%. The Fed became concerned that inflationary pressures were increasing and tightened monetary policy, raising the goal for the federal funds interest rate to 5.5%. Inflation remained well below 2.0% throughout the rest of 1997 and 1998. In the fall of 1998, with inflation low, the Fed was concerned that the economic recession in much of Asia and slow growth in Europe would reduce growth in the United States. In quarter-point steps, it reduced the goal for the federal funds rate to 4.75%. With real GDP growing briskly in the first half of 1999, the Fed became concerned that inflation would increase, even though the inflation rate at the time was about 2%, and in June 1999, it raised its goal for the federal funds rate to 5% and continued raising the rate until it reached 6.5% in May 2000.

With inflation under control, it then began lowering the federal funds rate to stimulate the economy. It continued lowering through the brief recession of 2001 and beyond. There were 11 rate cuts in 2001, with the rate at the end of that year at 1.75%; in late 2002 the rate was cut to 1.25%, and in mid-2003 it was cut to 1.0%.

Then, with growth picking up and inflation again a concern, the Fed began again in the middle of 2004 to increase rates. By the end of 2006, the rate stood at 5.25% as a result of 17 quarter-point rate increases.

Starting in September 2007, the Fed, since 2006 led by Ben Bernanke, shifted gears and began lowering the federal funds rate, mostly in larger steps or 0.5 to 0.75 percentage points. Though initially somewhat concerned with inflation, it sensed that the economy was beginning to slow down. It moved aggressively to lower rates over the course of the next 15 months, and by the end of 2008, the rate was targeted at between 0% and 0.25%. In late 2008 through 2011, beginning with the threat of deflation and then progressing into a period during which inflation ran fairly low, the Fed seemed quite willing to use all of its options to try to keep financial markets running smoothly. The Fed attempted, in the initial period, to moderate the recession, and then it tried to support the rather lackluster growth that followed. In January 2012, the Fed went on record to say that given its expectation that inflation would remain under control and that the economy would have slack, it anticipated keeping the federal funds rate at extremely low levels through late 2014.

What can we infer from these episodes in the 1980s, 1990s, and the first decade of this century? It seems clear that the Fed is determined not to allow the high inflation rates of the 1970s to occur again. When the inflation rate is within acceptable limits, the Fed will undertake stimulative measures in response to a recessionary gap or even in response to the possibility of a growth slowdown. Those limits seem to have tightened over time. In the late 1990s and early 2000s, it appeared that an inflation rate above 3%—or any indication that inflation might rise above 3%—would lead the Fed to adopt a contractionary policy. While on the Federal Reserve Board in the early 2000s, Ben Bernanke had been an advocate of inflation targeting. Under that system, the central bank announces its inflation target and then adjusts the federal funds rate if the inflation rate moves above or below the central bank’s target. Mr. Bernanke indicated his preferred target to be an expected increase in the price level, as measured by the price index for consumer goods and services excluding food and energy, of between 1% and 2%. Thus, the inflation goal appears to have tightened even more—to a rate of 2% or less. If inflation were expected to remain below 2%, however, the Fed would undertake stimulative measures to close a recessionary gap. Whether the Fed will hold to that goal will not really be tested until further macroeconomic experiences unfold.

Monetary Policy and Macroeconomic Variables

We saw in an earlier chapter that the Fed has three tools at its command to try to change aggregate demand and thus to influence the level of economic activity. It can buy or sell federal government bonds through open-market operations, it can change the discount rate, or it can change reserve requirements. It can also use these tools in combination. In the next section of this chapter, where we discuss the notion of a liquidity trap, we will also introduce more extraordinary measures that the Fed has at its disposal.

Most economists agree that these tools of monetary policy affect the economy, but they sometimes disagree on the precise mechanisms through which this occurs, on the strength of those mechanisms, and on the ways in which monetary policy should be used. Before we address some of these issues, we shall review the ways in which monetary policy affects the economy in the context of the model of aggregate demand and aggregate supply. Our focus will be on open-market operations, the purchase or sale by the Fed of federal bonds.

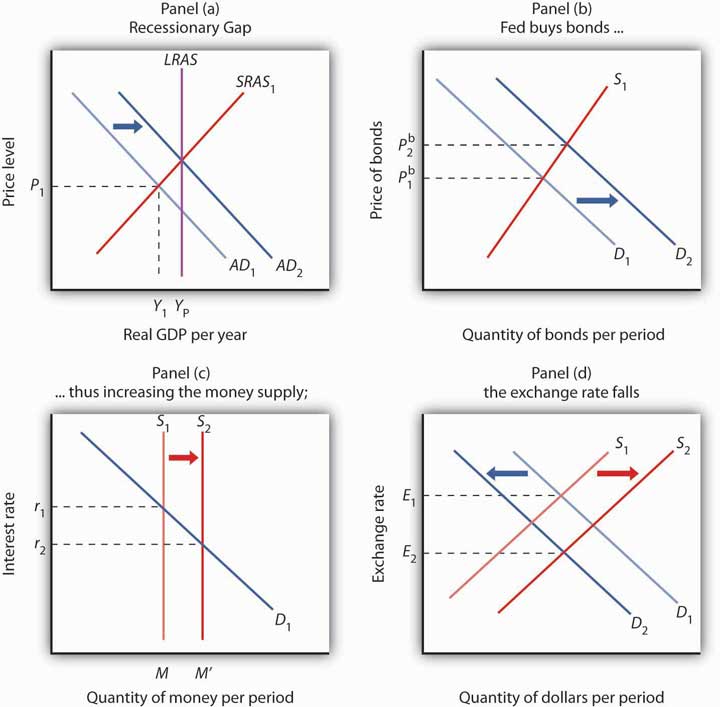

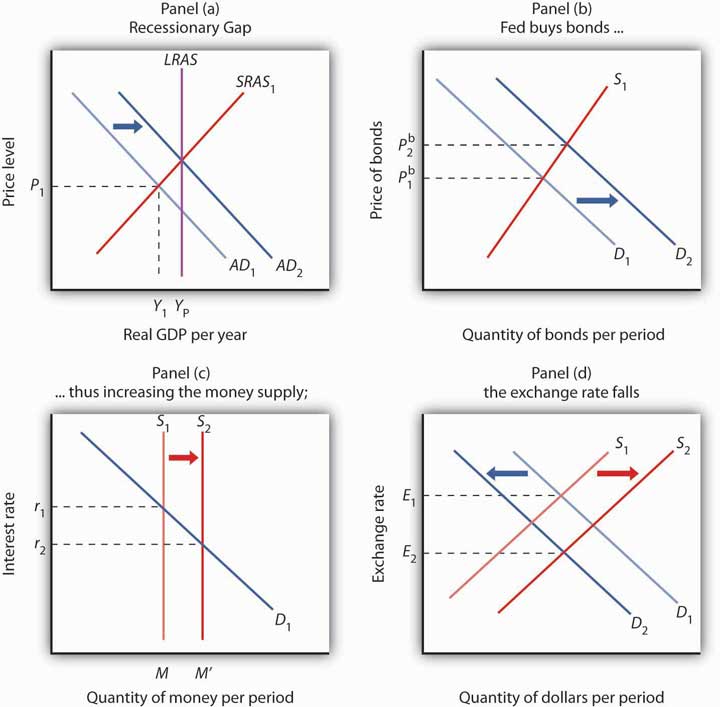

Expansionary Monetary Policy

The Fed might pursue an expansionary monetary policy in response to the initial situation shown in Panel (a) of Figure 1. An economy with a potential output of YP is operating at Y1; there is a recessionary gap. One possible policy response is to allow the economy to correct this gap on its own, waiting for reductions in nominal wages and other prices to shift the short-run aggregate supply curve SRAS1 to the right until it intersects the aggregate demand curve AD1 at YP. An alternative is a stabilization policy that seeks to increase aggregate demand to AD2 to close the gap. An expansionary monetary policy is one way to achieve such a shift.

To carry out an expansionary monetary policy, the Fed will buy bonds, thereby increasing the money supply. That shifts the demand curve for bonds to D2, as illustrated in Panel (b). Bond prices rise to Pb2. The higher price for bonds reduces the interest rate. These changes in the bond market are consistent with the changes in the money market, shown in Panel (c), in which the greater money supply leads to a fall in the interest rate to r2. The lower interest rate stimulates investment. In addition, the lower interest rate reduces the demand for and increases the supply of dollars in the currency market, reducing the exchange rate to E2 in Panel (d). The lower exchange rate will stimulate net exports. The combined impact of greater investment and net exports will shift the aggregate demand curve to the right. The curve shifts by an amount equal to the multiplier times the sum of the initial changes in investment and net exports. In Panel (a), this is shown as a shift to AD2, and the recessionary gap is closed.

In Panel (a), the economy has a recessionary gap YP − Y1. An expansionary monetary policy could seek to close this gap by shifting the aggregate demand curve to AD2. In Panel (b), the Fed buys bonds, shifting the demand curve for bonds to D2 and increasing the price of bonds to Pb2. By buying bonds, the Fed increases the money supply to M′ in Panel (c). The Fed’s action lowers interest rates to r2. The lower interest rate also reduces the demand for and increases the supply of dollars, reducing the exchange rate to E2 in Panel (d). The resulting increases in investment and net exports shift the aggregate demand curve in Panel (a).

Contractionary Monetary Policy

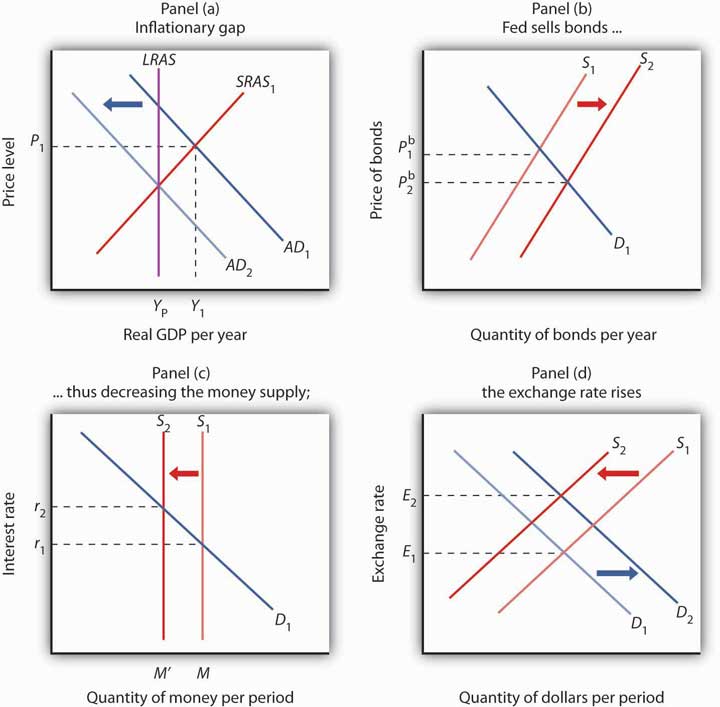

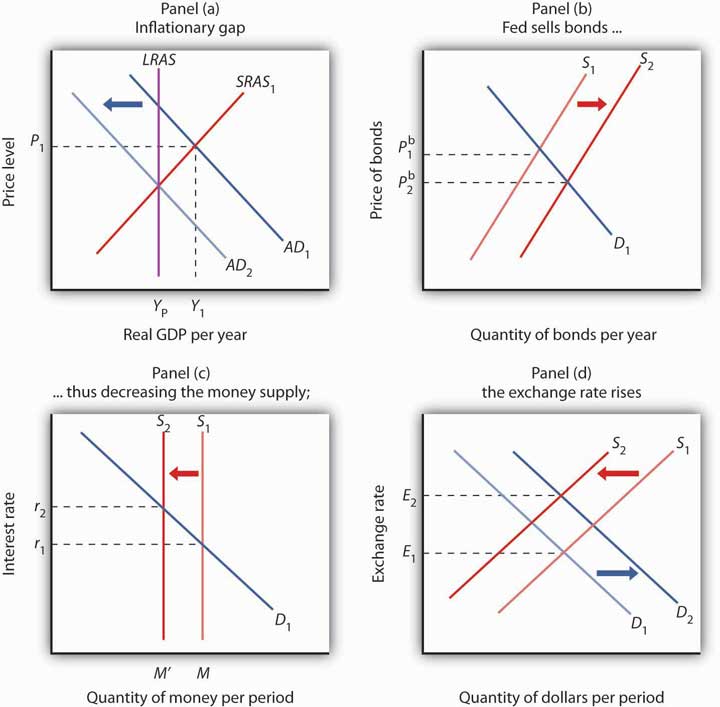

The Fed will generally pursue a contractionary monetary policy when it considers inflation a threat. Suppose, for example, that the economy faces an inflationary gap; the aggregate demand and short-run aggregate supply curves intersect to the right of the long-run aggregate supply curve, as shown in Panel (a) of Figure 2.

In Panel (a), the economy has an inflationary gap Y1 − YP. A contractionary monetary policy could seek to close this gap by shifting the aggregate demand curve to AD2. In Panel (b), the Fed sells bonds, shifting the supply curve for bonds to S2 and lowering the price of bonds to Pb2. The lower price of bonds means a higher interest rate, r2, as shown in Panel (c). The higher interest rate also increases the demand for and decreases the supply of dollars, raising the exchange rate to E2 in Panel (d), which will increase net exports. The decreases in investment and net exports are responsible for decreasing aggregate demand in Panel (a).

To carry out a contractionary policy, the Fed sells bonds. In the bond market, shown in Panel (b) of Figure 2, the supply curve shifts to the right, lowering the price of bonds and increasing the interest rate. In the money market, shown in Panel (c), the Fed’s bond sales reduce the money supply and raise the interest rate. The higher interest rate reduces investment. The higher interest rate also induces a greater demand for dollars as foreigners seek to take advantage of higher interest rates in the United States. The supply of dollars falls; people in the United States are less likely to purchase foreign interest-earning assets now that U.S. assets are paying a higher rate. These changes boost the exchange rate, as shown in Panel (d), which reduces exports and increases imports and thus causes net exports to fall. The contractionary monetary policy thus shifts aggregate demand to the left, by an amount equal to the multiplier times the combined initial changes in investment and net exports, as shown in Panel (a).

Case in Point: A Brief History of the Greenspan Fed

With the passage of time and the fact that the fallout on the economy turned out to be relatively minor, it is hard in retrospect to realize how scary a situation Alan Greenspan and the Fed faced just two months after his appointment as Chairman of the Federal Reserve Board. On October 12, 1987, the stock market had its worst day ever. The Dow Jones Industrial Average plunged 508 points, wiping out more than $500 billion in a few hours of feverish trading on Wall Street. That drop represented a loss in value of over 22%. In comparison, the largest daily drop in 2008 of 778 points on September 29, 2008, represented a loss in value of about 7%.

When the Fed faced another huge plunge in stock prices in 1929—also in October—members of the Board of Governors met and decided that no action was necessary. Determined not to repeat the terrible mistake of 1929, one that helped to usher in the Great Depression, Alan Greenspan immediately reassured the country, saying that the Fed would provide adequate liquidity, by buying federal securities, to assure that economic activity would not fall. As it turned out, the damage to the economy was minor and the stock market quickly regained value.

In the fall of 1990, the economy began to slip into recession. The Fed responded with expansionary monetary policy—cutting reserve requirements, lowering the discount rate, and buying Treasury bonds.

Interest rates fell quite quickly in response to the Fed’s actions, but, as is often the case, changes to the components of aggregate demand were slower in coming. Consumption and investment began to rise in 1991, but their growth was weak. Unemployment continued to rise because growth in output was too slow to keep up with growth in the labor force. It was not until the fall of 1992 that the economy started to pick up steam. This episode demonstrates an important difficulty with stabilization policy: attempts to manipulate aggregate demand achieve shifts in the curve, but with a lag.

Throughout the rest of the 1990s, with some tightening when the economy seemed to be moving into an inflationary gap and some loosening when the economy seemed to be possibly moving toward a recessionary gap—especially in 1998 and 1999 when parts of Asia experienced financial turmoil and recession and European growth had slowed down—the Fed helped steer what is now referred to as the Goldilocks (not too hot, not too cold, just right) economy.

The U.S. economy again experienced a mild recession in 2001 under Greenspan. At that time, the Fed systematically conducted expansionary policy. Similar to its response to the 1987 stock market crash, the Fed has been credited with maintaining liquidity following the dot-com stock market crash in early 2001 and the attacks on the World Trade Center and the Pentagon in September 2001.

When Greenspan retired in January 2006, many hailed him as the greatest central banker ever. As the economy faltered in 2008 and as the financial crisis unfolded throughout the year, however, the question of how the policies of Greenspan’s Fed played into the current difficulties took center stage. Testifying before Congress in October 2008, he said that the country faces a “once-in-a-century credit tsunami,” and he admitted, “I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in their firms.” The criticisms he has faced are twofold: that the very low interest rates used to fight the 2001 recession and maintained for too long fueled the real estate bubble, and that he did not promote appropriate regulations to deal with the new financial instruments that were created in the early 2000s. While supporting some additional regulations when he testified before Congress, he also warned that overreacting could be dangerous: “We have to recognize that this is almost surely a once-in-a-century phenomenon, and, in that regard, to realize the types of regulation that would prevent this from happening in the future are so onerous as to basically suppress the growth rate in the economy and . . . the standards of living of the American people.”

Advantages of the Fed

The Fed has some obvious advantages in its conduct of monetary policy. The two policy-making bodies, the Board of Governors and the Federal Open Market Committee (FOMC), are small and largely independent from other political institutions. Therefore, these bodies can reach decisions quickly and implement them immediately. Their relative independence from the political process, together with the fact that they meet in secret, allows them to operate outside the glare of publicity that might otherwise be focused on bodies that wield such enormous power.

Despite the apparent ease with which the Fed can conduct monetary policy, it still faces difficulties in its efforts to stabilize the economy. We examine some of the problems and uncertainties associated with monetary policy in this section.

Lags

Perhaps the greatest obstacle facing the Fed, or any other central bank, is the problem of lags. It is easy enough to show a recessionary gap on a graph and then to show how monetary policy can shift aggregate demand and close the gap. In the real world, however, it may take several months before anyone even realizes that a particular macroeconomic problem is occurring. When monetary authorities become aware of a problem, they can act quickly to inject reserves into the system or to withdraw reserves from it. Once that is done, however, it may be a year or more before the action affects aggregate demand.

The delay between the time a macroeconomic problem arises and the time at which policymakers become aware of it is called a recognition lag. The 1990–1991 recession, for example, began in July 1990. It was not until late October that members of the FOMC noticed a slowing in economic activity, which prompted a stimulative monetary policy. In contrast, the most recent recession began in December 2007, and Fed easing began in September 2007.

Recognition lags stem largely from problems in collecting economic data. First, data are available only after the conclusion of a particular period. Preliminary estimates of real GDP, for example, are released about a month after the end of a quarter. Thus, a change that occurs early in a quarter will not be reflected in the data until several months later. Second, estimates of economic indicators are subject to revision. The first estimates of real GDP in the third quarter of 1990, for example, showed it increasing. Not until several months had passed did revised estimates show that a recession had begun. And finally, different indicators can lead to different interpretations. Data on employment and retail sales might be pointing in one direction while data on housing starts and industrial production might be pointing in another. It is one thing to look back after a few years have elapsed and determine whether the economy was expanding or contracting. It is quite another to decipher changes in real GDP when one is right in the middle of events. Even in a world brimming with computer-generated data on the economy, recognition lags can be substantial.

Only after policymakers recognize there is a problem can they take action to deal with it. The delay between the time at which a problem is recognized and the time at which a policy to deal with it is enacted is called the implementation lag. For monetary policy changes, the implementation lag is quite short. The FOMC meets eight times per year, and its members may confer between meetings through conference calls. Once the FOMC determines that a policy change is in order, the required open-market operations to buy or sell federal bonds can be put into effect immediately.

Policymakers at the Fed still have to contend with the impact lag, the delay between the time a policy is enacted and the time that policy has its impact on the economy.

The impact lag for monetary policy occurs for several reasons. First, it takes some time for the deposit multiplier process to work itself out. The Fed can inject new reserves into the economy immediately, but the deposit expansion process of bank lending will need time to have its full effect on the money supply. Interest rates are affected immediately, but the money supply grows more slowly. Second, firms need some time to respond to the monetary policy with new investment spending—if they respond at all. Third, a monetary change is likely to affect the exchange rate, but that translates into a change in net exports only after some delay. Thus, the shift in the aggregate demand curve due to initial changes in investment and in net exports occurs after some delay. Finally, the multiplier process of an expenditure change takes time to unfold. It is only as incomes start to rise that consumption spending picks up.

The problem of lags suggests that monetary policy should respond not to statistical reports of economic conditions in the recent past but to conditions expected to exist in the future. In justifying the imposition of a contractionary monetary policy early in 1994, when the economy still had a recessionary gap, Greenspan indicated that the Fed expected a one-year impact lag. The policy initiated in 1994 was a response not to the economic conditions thought to exist at the time but to conditions expected to exist in 1995. When the Fed used contractionary policy in the middle of 1999, it argued that it was doing so to forestall a possible increase in inflation. When the Fed began easing in September 2007, it argued that it was doing so to forestall adverse effects to the economy of falling housing prices. In these examples, the Fed appeared to be looking forward. It must do so with information and forecasts that are far from perfect.

Estimates of the length of time required for the impact lag to work itself out range from six months to two years. Worse, the length of the lag can vary—when they take action, policymakers cannot know whether their choices will affect the economy within a few months or within a few years. Because of the uncertain length of the impact lag, efforts to stabilize the economy through monetary policy could be destabilizing. Suppose, for example, that the Fed responds to a recessionary gap with an expansionary policy but that by the time the policy begins to affect aggregate demand, the economy has already returned to potential GDP. The policy designed to correct a recessionary gap could create an inflationary gap. Similarly, a shift to a contractionary policy in response to an inflationary gap might not affect aggregate demand until after a self-correction process had already closed the gap. In that case, the policy could plunge the economy into a recession.

Choosing Targets

In attempting to manage the economy, on what macroeconomic variables should the Fed base its policies? It must have some target, or set of targets, that it wants to achieve. The failure of the economy to achieve one of the Fed’s targets would then trigger a shift in monetary policy. The choice of a target, or set of targets, is a crucial one for monetary policy. Possible targets include interest rates, money growth rates, and the price level or expected changes in the price level.

Interest Rates

Interest rates, particularly the federal funds rate, played a key role in recent Fed policy. The FOMC does not decide to increase or decrease the money supply. Rather, it engages in operations to nudge the federal funds rate up or down.

Up until August 1997, it had instructed the trading desk at the New York Federal Reserve Bank to conduct open-market operations in a way that would either maintain, increase, or ease the current “degree of pressure” on the reserve positions of banks. That degree of pressure was reflected by the federal funds rate; if existing reserves were less than the amount banks wanted to hold, then the bidding for the available supply would send the federal funds rate up. If reserves were plentiful, then the federal funds rate would tend to decline. When the Fed increased the degree of pressure on reserves, it sold bonds, thus reducing the supply of reserves and increasing the federal funds rate. The Fed decreased the degree of pressure on reserves by buying bonds, thus injecting new reserves into the system and reducing the federal funds rate.

The current operating procedures of the Fed focus explicitly on interest rates. At each of its eight meetings during the year, the FOMC sets a specific target or target range for the federal funds rate. When the Fed lowers the target for the federal funds rate, it buys bonds. When it raises the target for the federal funds rate, it sells bonds.

Money Growth Rates

Until 2000, the Fed was required to announce to Congress at the beginning of each year its target for money growth that year and each report dutifully did so. At the same time, the Fed report would mention that its money growth targets were benchmarks based on historical relationships rather than guides for policy. As soon as the legal requirement to report targets for money growth ended, the Fed stopped doing so. Since in recent years the Fed has placed more importance on the federal funds rate, it must adjust the money supply in order to move the federal funds rate to the level it desires. As a result, the money growth targets tended to fall by the wayside, even over the last decade in which they were being reported. Instead, as data on economic conditions unfolded, the Fed made, and continues to make, adjustments in order to affect the federal funds interest rate.

Price Level or Expected Changes in the Price Level

Some economists argue that the Fed’s primary goal should be price stability. If so, an obvious possible target is the price level itself. The Fed could target a particular price level or a particular rate of change in the price level and adjust its policies accordingly. If, for example, the Fed sought an inflation rate of 2%, then it could shift to a contractionary policy whenever the rate rose above 2%. One difficulty with such a policy, of course, is that the Fed would be responding to past economic conditions with policies that are not likely to affect the economy for a year or more. Another difficulty is that inflation could be rising when the economy is experiencing a recessionary gap. An example of this, mentioned earlier, occurred in 1990 when inflation increased due to the seemingly temporary increase in oil prices following Iraq’s invasion of Kuwait. The Fed faced a similar situation in the first half of 2008 when oil prices were again rising. If the Fed undertakes contractionary monetary policy at such times, then its efforts to reduce the inflation rate could worsen the recessionary gap.

The solution proposed by Chairman Bernanke, who is an advocate of inflation rate targeting, is to focus not on the past rate of inflation or even the current rate of inflation, but on the expected rate of inflation, as revealed by various indicators, over the next year.

By 2010, the central banks of about 30 developed or developing countries had adopted specific inflation targeting. Inflation targeters include Australia, Brazil, Canada, Great Britain, New Zealand, South Korea, and, most recently, Turkey and Indonesia. A study by economist Carl Walsh found that inflationary experiences among developed countries have been similar, regardless of whether their central banks had explicit or more flexible inflation targets. For developing countries, however, he found that inflation targeting enhanced macroeconomic performance, in terms of both lower inflation and greater overall stability. Carl E. Walsh, “Inflation Targeting: What Have We Learned?,” International Finance 12, no. 2 (2009): 195–233.

Political Pressures

The institutional relationship between the leaders of the Fed and the executive and legislative branches of the federal government is structured to provide for the Fed’s independence. Members of the Board of Governors are appointed by the president, with confirmation by the Senate, but the 14-year terms of office provide a considerable degree of insulation from political pressure. A president exercises greater influence in the choice of the chairman of the Board of Governors; that appointment carries a four-year term. Neither the president nor Congress has any direct say over the selection of the presidents of Federal Reserve district banks. They are chosen by their individual boards of directors with the approval of the Board of Governors.

The degree of independence that central banks around the world have varies. A central bank is considered to be more independent if it is insulated from the government by such factors as longer-term appointments of its governors and fewer requirements to finance government budget deficits. Studies in the 1980s and early 1990s showed that, in general, greater central bank independence was associated with lower average inflation and that there was no systematic relationship between central bank independence and other indicators of economic performance, such as real GDP growth or unemployment. See, for example, Alberto Alesina and Lawrence H. Summers, “Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence,” Journal of Money, Credit, and Banking 25, no. 2 (May 1993): 151–62. By the rankings used in those studies, the Fed was considered quite independent, second only to Switzerland and the German Bundesbank at the time. Perhaps as a result of such findings, a number of countries have granted greater independence to their central banks in the last decade. The charter for the European Central Bank, which began operations in 1998, was modeled on that of the German Bundesbank. Its charter states explicitly that its primary objective is to maintain price stability. Also, since 1998, central bank independence has increased in the United Kingdom, Canada, Japan, and New Zealand.

While the Fed is formally insulated from the political process, the men and women who serve on the Board of Governors and the FOMC are human beings. They are not immune to the pressures that can be placed on them by members of Congress and by the president. The chairman of the Board of Governors meets regularly with the president and the executive staff and also reports to and meets with congressional committees that deal with economic matters.

The Fed was created by the Congress; its charter could be altered—or even revoked—by that same body. The Fed is in the somewhat paradoxical situation of having to cooperate with the legislative and executive branches in order to preserve its independence.

The Degree of Impact on the Economy

The problem of lags suggests that the Fed does not know with certainty when its policies will work their way through the financial system to have an impact on macroeconomic performance. The Fed also does not know with certainty to what extent its policy decisions will affect the macroeconomy.

For example, investment can be particularly volatile. An effort by the Fed to reduce aggregate demand in the face of an inflationary gap could be partially offset by rising investment demand. But, generally, contractionary policies do tend to slow down the economy as if the Fed were “pulling on a rope.” That may not be the case with expansionary policies. Since investment depends crucially on expectations about the future, business leaders must be optimistic about economic conditions in order to expand production facilities and buy new equipment. That optimism might not exist in a recession. Instead, the pessimism that might prevail during an economic slump could prevent lower interest rates from stimulating investment. An effort to stimulate the economy through monetary policy could be like “pushing on a string.” The central bank could push with great force by buying bonds and engaging in quantitative easing, but little might happen to the economy at the other end of the string.

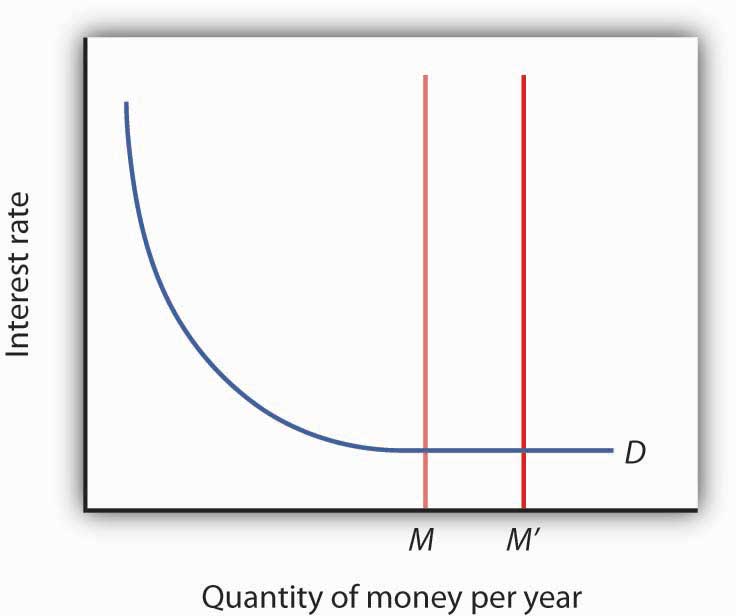

What if the Fed cannot bring about a change in interest rates? A liquidity trap is said to exist when a change in monetary policy has no effect on interest rates. This would be the case if the money demand curve were horizontal at some interest rate, as shown in Figure 3. If a change in the money supply from M to M′ cannot change interest rates, then, unless there is some other change in the economy, there is no reason for investment or any other component of aggregate demand to change. Hence, the traditional monetary policy is rendered totally ineffective; its degree of impact on the economy is nil. At an interest rate of zero, since bonds cease to be an attractive alternative to money, which is at least useful for transactions purposes, there would be a liquidity trap.

A Liquidity Trap

When a change in the money supply has no effect on the interest rate, the economy is said to be in a liquidity trap.

With the federal funds rate in the United States close to zero at the end of 2008, the possibility that the country was in or nearly in a liquidity trap could not be dismissed. As discussed in the introduction to the chapter, at the same time the Fed lowered the federal funds rate to close to zero, it mentioned that it intended to pursue additional, nontraditional measures. The Fed seeks to make firms and consumers want to spend now by using a tool not aimed at reducing the interest rate, since it cannot reduce the interest rate below zero. It shifts its focus to the price level and to avoiding expected deflation. For example, if the public expects the price level to fall by 2% and the interest rate is zero, by holding money, the money is actually earning a positive real interest rate of 2%—the difference between the nominal interest rate and the expected deflation rate. Since the nominal rate of interest cannot fall below zero (Who would, for example, want to lend at an interest rate below zero when lending is risky whereas cash is not? In short, it does not make sense to lend $10 and get less than $10 back.), expected deflation makes holding cash very attractive and discourages spending since people will put off purchases because goods and services are expected to get cheaper.

To combat this “wait-and-see” mentality, the Fed or another central bank, using a strategy referred to as quantitative easing, must convince the public that it will keep interest rates very low by providing substantial reserves for as long as is necessary to avoid deflation. In other words, it is aimed at creating expected inflation. For example, at the Fed’s October 2003 meeting, it announced that it would keep the federal funds rate at 1% for “a considerable period.” When the Fed lowered the rate to between 0% and 0.25% in December 2008, it added that “the committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.” After working so hard to convince economic players that it will not tolerate inflation above 2%, the Fed, when in such a situation, must convince the public that it will tolerate inflation, but of course not too much! If it is successful, this extraordinary form of expansionary monetary policy will lead to increased purchases of goods and services, compared to what they would have been with expected deflation. Also, by providing banks with considerable liquidity, the Fed is hoping to encourage them to lend.

The Japanese economy provides an interesting modern example of a country that attempted quantitative easing. With a recessionary gap starting in the early 1990s and deflation in most years from 1995 on, Japan’s central bank, the Bank of Japan, began to lower the call money rate (equivalent to the federal funds rate in the United States), reaching near zero by the late 1990s. With growth still languishing, Japan appeared to be in a traditional liquidity trap. In late 1999, the Bank of Japan announced that it would maintain a zero interest rate policy for the foreseeable future, and in March 2001 it officially began a policy of quantitative easing. In 2006, with the price level rising modestly, Japan ended quantitative easing and began increasing the call rate again. It should be noted that the government simultaneously engaged in expansionary fiscal policy.

How well did these policies work in Japan? The economy began to grow modestly in 2003, though deflation between 1% and 2% remained. Some researchers feel that the Bank of Japan ended quantitative easing too early. Also, delays in implementing the policy, as well as delays in restructuring the banking sector, exacerbated Japan’s problems.“Bringing an End to Deflation under the New Monetary Policy Framework,” OECD Economic Surveys: Japan 2008 4 (April 2008): 49–61 and Mark M. Spiegel, “Did Quantitative Easing by the Bank of Japan Work?” FRBSF Economic Letter 2006, no. 28 (October 20, 2006): 1–3.

Fed Chairman Bernanke and other Fed officials have argued that the Fed is also engaged in credit easing. Ben S. Bernanke, “The Crisis and the Policy Response” (Stamp Lecture, London School of Economics, London, England, January 13, 2009) and Janet L. Yellen, “U.S. Monetary Policy Objectives in the Short Run and the Long Run” (speech, Allied Social Sciences Association annual meeting, San Francisco, California, January 4, 2009). Credit easing is a strategy that involves the extension of central bank lending to influence more broadly the proper functioning of credit markets and to improve liquidity. The specific new credit facilities that the Fed has created were discussed in the Case in Point in the chapter on the nature and creation of money. In general, the Fed is hoping that these new credit facilities will improve liquidity in a variety of credit markets, ranging from those used by money market mutual funds to those involved in student and car loans.

Rational Expectations

One hypothesis suggests that monetary policy may affect the price level but not real GDP. The rational expectations hypothesis states that people use all available information to make forecasts about future economic activity and the price level, and they adjust their behavior to these forecasts.

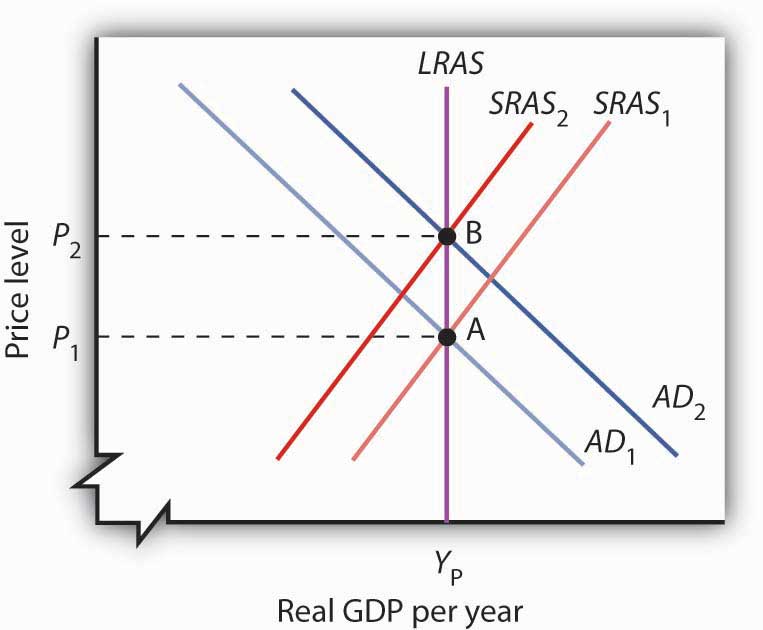

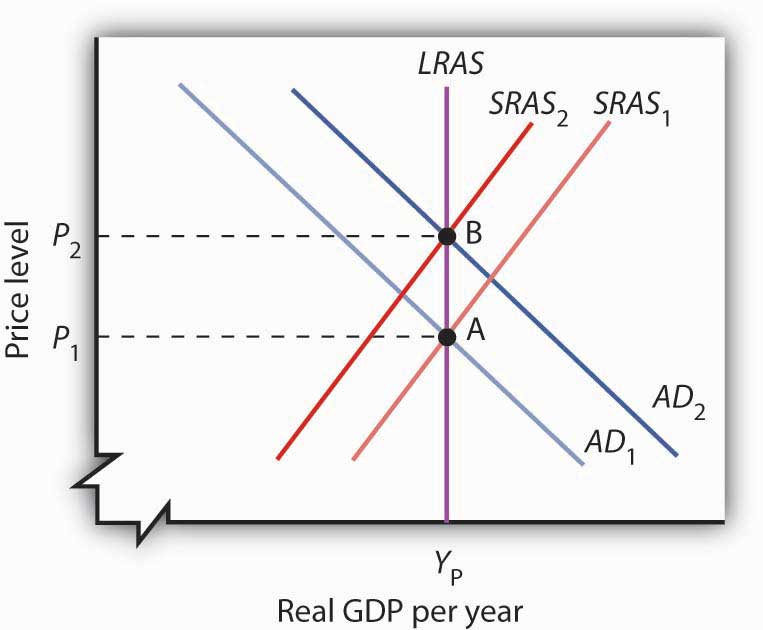

Figure 4 uses the model of aggregate demand and aggregate supply to show the implications of the rational expectations argument for monetary policy. Suppose the economy is operating at YP, as illustrated by point A. An increase in the money supply boosts aggregate demand to AD2. In the analysis we have explored thus far, the shift in aggregate demand would move the economy to a higher level of real GDP and create an inflationary gap. That, in turn, would put upward pressure on wages and other prices, shifting the short-run aggregate supply curve to SRAS2 and moving the economy to point B, closing the inflationary gap in the long run. The rational expectations hypothesis, however, suggests a quite different interpretation.

Monetary Policy and Rational Expectations

Suppose the economy is operating at point A and that individuals have rational expectations. They calculate that an expansionary monetary policy undertaken at price level P1 will raise prices to P2. They adjust their expectations—and wage demands—accordingly, quickly shifting the short-run aggregate supply curve to SRAS2. The result is a movement along the long-run aggregate supply curve LRAS to point B, with no change in real GDP.

Suppose people observe the initial monetary policy change undertaken when the economy is at point A and calculate that the increase in the money supply will ultimately drive the price level up to point B. Anticipating this change in prices, people adjust their behavior. For example, if the increase in the price level from P1 to P2 is a 10% change, workers will anticipate that the prices they pay will rise 10%, and they will demand 10% higher wages. Their employers, anticipating that the prices they will receive will also rise, will agree to pay those higher wages. As nominal wages increase, the short-run aggregate supply curve immediately shifts to SRAS2. The result is an upward movement along the long-run aggregate supply curve, LRAS. There is no change in real GDP. The monetary policy has no effect, other than its impact on the price level. This rational expectations argument relies on wages and prices being sufficiently flexible—not sticky, as described in an earlier chapter—so that the change in expectations will allow the short-run aggregate supply curve to shift quickly to SRAS2.

One important implication of the rational expectations argument is that a contractionary monetary policy could be painless. Suppose the economy is at point B in Figure 11.5, and the Fed reduces the money supply in order to shift the aggregate demand curve back to AD1. In the model of aggregate demand and aggregate supply, the result would be a recession. But in a rational expectations world, people’s expectations change, the short-run aggregate supply immediately shifts to the right, and the economy moves painlessly down its long-run aggregate supply curve LRAS to point A. Those who support the rational expectations hypothesis, however, also tend to argue that monetary policy should not be used as a tool of stabilization policy.

For some, the events of the early 1980s weakened support for the rational expectations hypothesis; for others, those same events strengthened support for this hypothesis. As we saw in the introduction to an earlier chapter, in 1979 President Jimmy Carter appointed Paul Volcker as Chairman of the Federal Reserve and pledged his full support for whatever the Fed might do to contain inflation. Mr. Volcker made it clear that the Fed was going to slow money growth and boost interest rates. He acknowledged that this policy would have costs but said that the Fed would stick to it as long as necessary to control inflation. Here was a monetary policy that was clearly announced and carried out as advertised. But the policy brought on the most severe recession since the Great Depression—a result that seems inconsistent with the rational expectations argument that changing expectations would prevent such a policy from having a substantial effect on real GDP.

Others, however, argue that people were aware of the Fed’s pronouncements but were skeptical about whether the anti-inflation effort would persist, since the Fed had not vigorously fought inflation in the late 1960s and the 1970s. Against this history, people adjusted their estimates of inflation downward slowly. In essence, the recession occurred because people were surprised that the Fed was serious about fighting inflation.

Regardless of where one stands on this debate, one message does seem clear: once the Fed has proved it is serious about maintaining price stability, doing so in the future gets easier. To put this in concrete terms, Volcker’s fight made Greenspan’s work easier, and Greenspan’s legacy of low inflation should make Bernanke’s easier.

Video: Former Fed Chairman Alan Greenspan on the U.S. Economy

Answer the self check questions below to monitor your understanding of the concepts in this section.

Answer the self check questions below to monitor your understanding of the concepts in this section.Self Check Questions

- What is the monetary policy?

- What is the fractional reserve system?

- What are legal reserves?

- What is a reserve requirement?

- What are the 6 tools of monetary policy?

- What is the difference between an easy money policy and a tight money policy?

- Research current interest rates online. Is the U.S. in an easy or tight money policy right now? How can you tell? Why would the government want to have this type of money policy now?

| Image | Reference | Attributions |

|

[Figure 1] | Credit: Opentextbooks.org Source: http://www.opentextbooks.org.hk/ditatopic/7911 License: CC BY-NC 3.0 |

|

[Figure 2] | Credit: Opentextbooks.org Source: http://www.opentextbooks.org.hk/ditatopic/7911 License: CC BY-NC 3.0 |

|

[Figure 5] | Credit: Opentextbooks.org Source: http://www.opentextbooks.org.hk/ditatopic/7921 License: CC BY-NC 3.0 |