4.1: State and Local Tax Systems

- Page ID

- 6936

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)State and Local Tax Systems

State governments receive revenues from the federal government and the local government. Local governments benefit from intergovernmental revenues from the federal and state governments, as well as from property taxes, excise taxes, sales taxes, utility taxes, and other sources.

Universal Generalizations

- Taxes influence the economy by affecting resource allocation, consumer behavior, as well as state and local productivity and growth.

- The state and local government raises revenue from a variety of taxes.

- State and local economic policies can influence levels of employment, output, and prices.

Guiding Questions

- How do government policies of taxing and spending affect the economy at the state and local levels?

- What are the positive and negative aspects of taxation?

- How do taxes contribute to state government spending?

- How do taxes contribute to local government spending?

State and Local Taxes

Lincoln Park Murals in El Paso, Texas.

Lincoln Park Murals in El Paso, Texas.All levels of the government collect taxes: federal, state, and local government. Governments collect taxes so they may have “revenues” to turn around and use for “programs”. Clearly, the money to pay for new roads, schools, hospitals, and even customs and border protection has to come from somewhere, and that somewhere is from you and me. We pay taxes to be able to benefit from the programs and products that all three levels of government provide.

Property Taxes

Property taxes are taxes imposed on assets. Local governments, for example, generally impose a property tax on business and personal property. A government official (typically a local assessor) determines the property’s value, and a proportional tax rate is then applied to that value. Property ownership tends to be concentrated among higher income groups; economists generally view property taxes as progressive.

Sales Taxes

Sales taxes are taxes imposed as a percentage of firms’ sales and are generally imposed on retail sales. Some items, such as food and medicine, are often exempted from sales taxation. People with lower incomes generally devote a larger share of their incomes to consumption of goods covered by sales taxes than do people with higher incomes. Sales taxes are thus likely to be regressive.

Excise Taxes

An excise tax is imposed on specific items. In some cases, excise taxes are justified as a way of discouraging the consumption of demerit goods, such as cigarettes and alcoholic beverages. In other cases, an excise tax is a kind of benefits-received tax. Excise taxes on gasoline, for example, are typically earmarked for use in building and maintaining highways, so that those who pay the tax are the ones who benefit from the service provided. The most important excise tax in the United States is the payroll tax imposed on workers’ earnings. The proceeds of this excise on payrolls finance Social Security and Medicare benefits. Most U.S. households pay more in payroll taxes than in any other taxes.

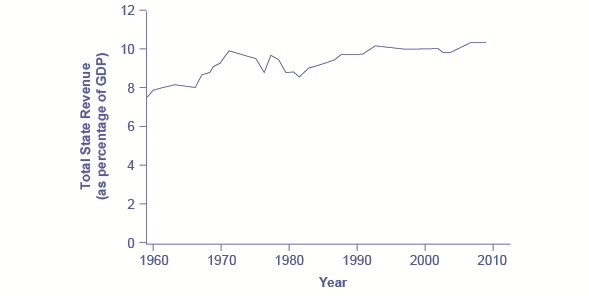

At the state and local level, taxes have been rising as a share of GDP over the last few decades to match the gradual rise in spending, as Figure 2 illustrates. The main revenue sources for state and local governments are sales taxes, property taxes, and revenue passed along from the federal government, but many state and local governments also levy personal and corporate income taxes, as well as impose a wide variety of fees and charges. The specific sources of tax revenue vary widely across state and local governments. Some states rely more on property taxes, some on sales taxes, some on income taxes, and some more on revenues from the federal government.

State and Local Tax Revenue as a Share of GDP, 1960–2010

State and local tax revenues have increased to match the rise in state and local spending. (Source: Economic Report of the President, Tables B-85 and B-1,

The federal government shares some of its revenues that it collects with both the states and local governments in the form of “intergovernmental revenues”. These funds are collected by one level of government and then shared with other levels for the purpose of funding specific areas such as welfare, healthcare, and education. Some states may receive up to 20% of their funding from intergovernmental revenues, and local governments may get up to 1/3 of their budgets from either the state or federal government. The largest portion of state and local monies come from the sales tax. Merchants and businesses collect taxes on products that they sell. The business must then give a portion of that tax to the state on a regular basis. Some businesses are allowed to keep a small portion of the tax to compensate them for their time and the cost of keeping track of the amount of tax revenues that they have collected and subsequently given to the states. Some states such as Delaware, New Hampshire, Montana, Oregon, and Alaska, do not collect a state sales tax. Those states that do not collect state sales taxes may have higher taxes for other things such as property taxes, liquor taxes, or state income taxes.

Visit the Tax Policy Center website to learn more about the U.S. tax system.

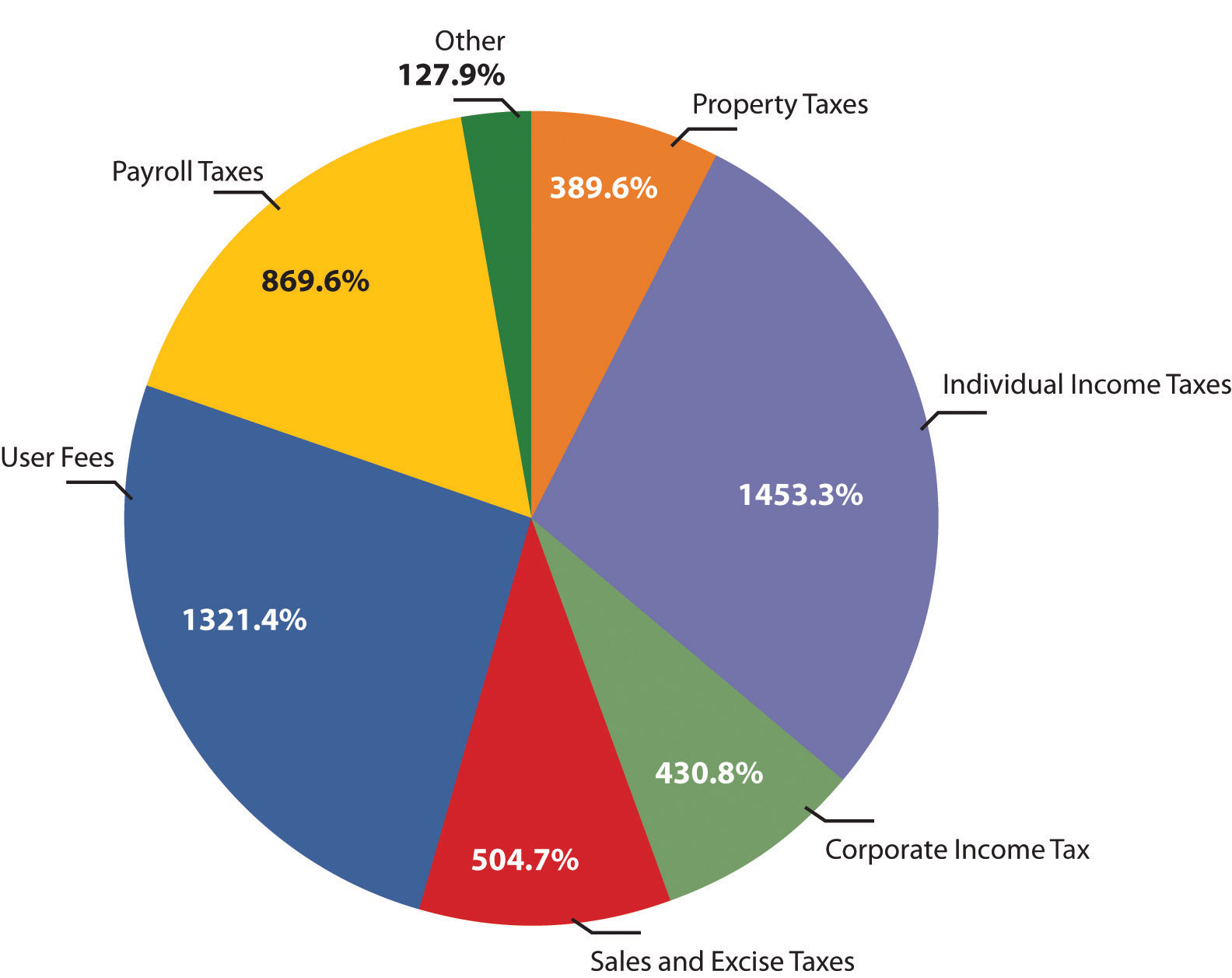

Sources of Government Revenue

The chart shows sources of revenue for federal, state, and local governments in the United States. The data omit revenues from government-owned utilities and liquor stores. All figures are in billions of dollars. Data are for 2007.

Source: U.S. Bureau of the Census, Statistical Abstract of US, 2011 (online) Tables 434 and 473. retrieved from

Video: Calculating State Taxes and Take Home Pay

How Will This Affect Your Income?

It is hard to imagine anything that has not been taxed at one time or another. Windows, closets, buttons, junk food, salt, death—all have been singled out for special taxes. In general, taxes fall into one of four primary categories. Income taxes are imposed on the income earned by a person or firm; property taxes are imposed on assets; sales taxes are imposed on the value of goods sold; and excise taxes are imposed on specific goods or services. Figure 3 Sources of Government Revenue shows the major types of taxes financing all levels of government in the United States.

Answer the self check questions below to monitor your understanding of the concepts in this section.

Answer the self check questions below to monitor your understanding of the concepts in this section.Self Check Questions

- What are intergovernmental revenues?

- Go online and find out which states have a "state income tax." Which state has the highest tax? Which state has the lowest?

- Go online and find out which states have a "state sales tax" on merchandise. Which state has the highest sales tax? Which state has the lowest sales tax? What is the sales tax for Texas?

- How else can a state earn money? What other types of taxes are there?

- What is the largest source of local revenues?