4.13: Revenue- The Economics of Taxation

- Page ID

- 6930

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Revenue: The Economics of Taxation

Every government collects taxes in order to generate money to pay for the operation of the government, to fund programs, and to pay for interest on its debt. So where does the money come from? How do taxes affect individuals and businesses? Economists examine how taxes and other government revues influence productivity, growth, consumers, and resource allocation. Taxes are considered a burden since it can change the incentives to save, invest, and work. The people or companies being taxed, or the incidence of a tax, can be predicted by supply and demand. In effect, the tax on a good or service will either be absorbed by the producer or passed on to the consumer. Taxes can either encourage or discourage consumer activities. A positive aspect of a tax would be that homeowners are allowed to use interest payments on their mortgages as a tax deduction, while a sin tax is a high tax individuals pay on a socially undesirable product such as tobacco. The simplest effect is that taxes raise the final cost of a good or service and consumers will react by purchasing less of the product.

Universal Generalizations

- Taxes influence the economy by affecting resource allocation, consumer behavior, and the nation’s productivity and growth.

- Taxes are the single most important way for the government to raise revenue.

- Government economic policies at all levels influence levels of employment, output, and price levels.

Guiding Questions

- What does the government do with the tax money it collects?

- How do government policies of taxing and spending affect the economy at the national, state, and local levels?

All three levels of government within the United States require an enormous amount of money to run its programs and institute its policies. According to the U.S. government, all three levels (federal, state, local) collected nearly $6 trillion dollars in revenues for the fiscal year 2015. Since the end of World War II, revenues have grown exponentially. When adjusted for inflation and population, revenues have grown by more than 800%. Taxes can influence the economy by affecting various aspects of consumer behavior, resource allocation, growth, and productivity, as well as saving and spending, since the burden of taxes can be transferred to others.

Video: Basics of U.S. Income Tax Rate Schedule

Source: Khan Academy, Basics of US Income Tax Rate Schedule, https://youtu.be/OGVJfcSckUs

Elasticity and Tax Incidence

The example of cigarette taxes showed that because demand is inelastic, taxes are not effective at reducing the equilibrium quantity of smoking, and they are mainly passed along to consumers in the form of higher prices. The analysis, or manner, of how the burden of a tax is divided between consumers and producers is called tax incidence. Typically, the incidence, or burden, of a tax falls both on the consumers and producers of the taxed good, but if one wants to predict which group will bear most of the burden, all one needs to do is examine the elasticity of demand and supply. In the tobacco example, the tax burden falls on the most inelastic side of the market.

If demand is more inelastic than supply, consumers bear most of the tax burden, and if supply is more inelastic than demand, sellers bear most of the tax burden.

The intuition for this is simple. When the demand is inelastic, consumers are not very responsive to price changes, and the quantity demanded remains relatively constant when the tax is introduced. In the case of smoking, the demand is inelastic because consumers are addicted to the product. The government can then pass the tax burden along to consumers in the form of higher prices, without much of a decline in the equilibrium quantity.

Similarly, when a tax is introduced in a market with an inelastic supply, such as, for example, beachfront hotels, and sellers have no alternative than to accept lower prices for their business, taxes do not greatly affect the equilibrium quantity. The tax burden is now passed on to the sellers. If the supply was elastic and sellers had the possibility of reorganizing their businesses to avoid supplying the taxed good, the tax burden on the sellers would be much smaller. The tax would result in a much lower quantity sold instead of lower prices received. Figure 1 illustrates this relationship between the tax incidence and elasticity of demand and supply.

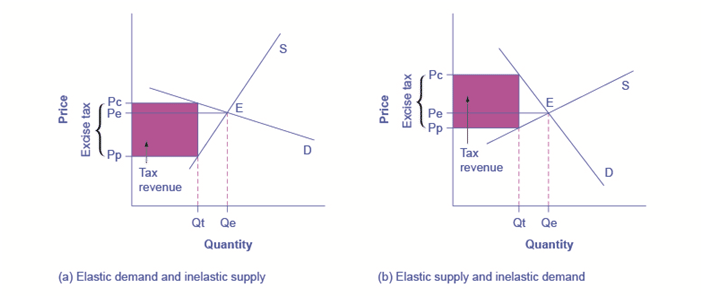

Elasticity and Tax Incidence

An excise tax introduces a wedge between the price paid by consumers (Pc) and the price received by producers (Pp). (a) When the demand is more elastic than supply, the tax incidence on consumers Pc – Pe is lower than the tax incidence on producers Pe – Pp. (b) When the supply is more elastic than demand, the tax incidence on consumers Pc – Pe is larger than the tax incidence on producers Pe – Pp. The more elastic the demand and supply curves are, the lower the tax revenue.

In Figure 1 (a), the supply is inelastic and the demand is elastic, such as in the example of beachfront hotels. While consumers may have other vacation choices, sellers can’t easily move their businesses. By introducing a tax, the government essentially creates a wedge between the price paid by consumers Pc and the price received by producers Pp. In other words, of the total price paid by consumers, part is retained by the sellers and part is paid to the government in the form of a tax. The distance between Pc and Pp is the tax rate. The new market price is Pc, but sellers receive only Pp per unit sold, as they pay Pc-Pp to the government. Since a tax can be viewed as raising the costs of production, this could also be represented by a leftward shift of the supply curve, where the new supply curve would intercept the demand at the new quantity Qt. For simplicity, Figure 1 omits the shift in the supply curve.

The tax revenue is shown by the shaded area, which is obtained by multiplying the tax per unit by the total quantity sold Qt. The tax incidence on the consumers is given by the difference between the price paid Pc and the initial equilibrium price Pe. The tax incidence on the sellers is given by the difference between the initial equilibrium price Pe and the price they receive after the tax is introduced Pp. In Figure 1 (a), the tax burden falls disproportionately on the sellers, and a larger proportion of the tax revenue (the shaded area) is due to the resulting lower price received by the sellers than by the resulting higher prices paid by the buyers. The example of the tobacco excise tax could be described by Figure 1 (b) where the supply is more elastic than demand. The tax incidence now falls disproportionately on consumers, as shown by the large difference between the price they pay, Pc, and the initial equilibrium price, Pe. Sellers receive a lower price than before the tax, but this difference is much smaller than the change in consumers’ price. From this analysis one can also predict whether a tax is likely to create a large revenue or not. The more elastic the demand curve, the easier it is for consumers to reduce quantity instead of paying higher prices. The more elastic the supply curve, the easier it is for sellers to reduce the quantity sold, instead of taking lower prices. In a market where both the demand and supply are very elastic, the imposition of an excise tax generates low revenue.

Excise taxes tend to be thought to hurt mainly the specific industries they target. For example, the medical device excise tax, in effect since 2013, has been controversial for it can delay industry profitability and therefore hamper start-ups and medical innovation. But ultimately, whether the tax burden falls mostly on the medical device industry or on the patients depends simply on the elasticity of demand and supply.

Consumer Behavior

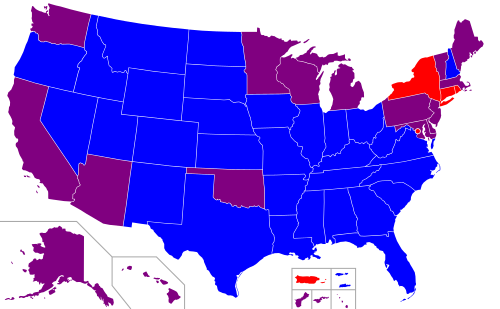

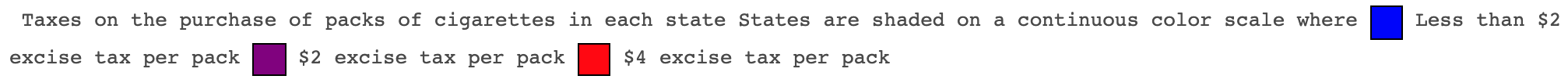

In 1998 American tobacco companies were sued by the states. Tobacco companies agreed to pay annual sums of money to the states to compensate them for health-care costs related to smoking and the states increased "sin taxes" to reduce consumer consumption. A sin tax can increase the cost of the product to help off set the economic cost to others and to decrease a particular behavior. Efforts to tax tobacco in the U.S. have generated several million dollars of excess revenues for the states, however, it has not impacted current tobacco users. Tobacco is an inelastic product and the taxes have not significantly affected consumption.

upload.wikimedia.org/Wikipedia/commons/thumb/7/73/Cigarette_Tax_Per_State.svg/500px-Cigarette_Tax_Per_State.svg.png

For more information on taxes and consumption see: A Behavioral Economics Perspective on Tobacco Taxation.

In addition to sin taxes, there are taxes that can encourage certain types of activities, such as adding solar power to a house can earn a homeowner a tax credit. Home ownership is encouraged, so the federal government will allow homeowners to use interest payments on mortgages as a tax deduction.

Resource Allocation

Whenever a tax is levied, it will affect production. That is because a tax placed on a good will increase the price of that product when it is sold. This tax can shift the supply curve to the left, and the cost of the tax will eventually be passed on to the consumer. When a product increases in price, consumer reaction is predictable --- they buy less. When sales fall, the producer may have to cut back on production or cut labor costs to cover the decrease in product sales. If sales fall and do not rebound, it may impact the other factors of production. If this occurs, then labor, capital, or entrepreneurs may have to move to other industries and be "reallocated". If the products are "elastic" then consumers generally will purchase substitutes if they are less expensive, or they will not purchase the more costly items until the market readjusts. If the product is inelastic, then the consumer may have no choice but to purchase it, while adjusting spending in other areas to offset the increase in prices.

Productivity and Growth

Lastly, taxes can impact both productivity and economic growth. There is a theory that if taxes go up, people will be less inclined to work hard to earn more money since they will need to pay more in taxes. It is hard to quantify if this theory is, in fact, valid. If people work hard, earn extra money, then pay more in taxes, will they really decide that the extra money they have made is not worth it since they had to pay more in taxes at the end of the year? It is doubtful. The extra amount of taxes paid are indexed and because the taxes are taken out of a person's pay before he or she ever sees it, there should be no negative consequences. Of course, a person may be upset at how much has been taken out for the purposes of paying taxes, but the additional earnings should off-set any reasonable amount paid in taxes. There is probably a level at which too many taxes, or too high of taxes, can affect productivity and growth, and this is therefore why people want lower taxes.

Effective Taxes

Taxes must meet three criteria for people to be willing to pay them: efficient, simple, and equitable. Effective taxes must be efficient so that they are easy to administer and successful at generating enough revenue. Depending on the tax it may be very efficient, like individual income taxes, or less efficient such as toll road taxes. Individual income taxes are withheld from a person's paycheck and sent directly to the Internal Revenue Service. At the end of the year, the employee has paid his or her taxes, and now the paperwork must be completed to verify the total amount that should have been withheld from the employee's income. Since payroll taxes are computerized, there is no burden for either the employer nor the employee, to have the taxes withheld.

On the other hand, a less effective tax such as the toll road tax is collected as people use the roads. The reason that the tax is less efficient is due to the high cost of collecting the tax such as building toll booths, hiring workers to man the booths, and the cost the consumer pays to use the road, as well as the stop and go traffic on the road. States have toll roads to offset the cost of the construction and maintenance of the roads, but the burden of the toll roads do not always generate the revenue needed, and therefore states try to find other ways to create revenues, such as renewing license plates or having automobiles pass state inspections each year.

The taxes also need to generate enough revenue. If the government institutes a tax that does not generate money, it may have a negative impact on the industry that it is taxing.

Taxes should be fair. In fact, most people believe that they only way taxes can be effective is if everyone pays their fair share. The question arises as to what is fair? Should only the wealthy pay taxes? Should everyone pay the same amount in taxes? Should people pay taxes in proportion to what they make? There is a concern that tax loopholes allow some people to avoid paying taxes, or at least not as much in taxes as they should. Such loopholes are opposed on the grounds of fairness, but there is an argument that if you knew of a loophole that was to your benefit, you may use it yourself. In conclusion, taxes would be considered more fair if there were fewer exceptions.

Taxes and the subsequent tax law should be simple and easy to understand by those paying the taxes and those creating the taxes. People are more willing to pay their taxes if they understood them. The tax code for the United States is very long and difficult to understand. Each year the Congress adds, deletes, and changes tax laws and tax brackets. Tax preparers, as well as taxpayers, must attempt to keep up with the changes or be penalized. Many people are unhappy with the current tax laws and have called for changes to not only how taxes are assessed (flat tax), but also changes to tax brackets. An example of a simple tax is a sales tax. This tax is assessed at the time of a purchase and the taxes are based on the total price of the product being taxed. The current sales tax rate for El Paso, Texas, is 8.25%.

If you purchase $10.00 worth of goods, then multiply 8.25% to pay a total of $0.83 in taxes for a total of $10.83.

If you purchase $22.00 worth of goods, then multiply 8.25% to pay a total of $1.82 in taxes for a total of $23.82.

Go to Sales Tax Calculator for a sales tax calculator.

Types of Taxes

In the United States, there are three types of taxes: proportional, progressive and regressive.

Proportional taxes: the tax rate is the same for everyone regardless of income. For example, if the tax rate is 10%, then everyone, regardless of their income pays the same rate. If a person earned $100,000 and was taxed at 10% then the tax would be only $10,000. However, if a person only made $10,000 in one year then his tax would be $1,000 -- -to this person it would be much more of a burden.

Video: Proportional Tax

Video unavailable

Progressive taxes: the tax rate is on a sliding scale, and the more money one earns, the more he/she pays in taxes. Progressive taxes use a marginal tax rate to adjust to the various levels of income that people may earn.

Video: The Progressive Income Tax: A Tale

The following chart is for 2014 Tax brackets by income and is considered progressive

| Tax rate | Single filers | Married filing jointly or qualifying widow/widower | Married filing separately | Head of household |

| 10% | Up to $9,075 | Up to $18,150 | Up to $9,075 | Up to $12,950 |

| 15% | $9,076 to $36,900 | $18,151 to $73,800 | $9,076 to $36,900 | $12,951 to $49,400 |

| 25% | $36,901 to $89,350 | $73,801 to $148,850 | $36,901 to $74,425 | $49,401 to $127,550 |

| 28% | $89,351 to $186,350 | $148,851 to $226,850 | $74,426 to $113,425 | $127,551 to $206,600 |

| 33% | $186,351 to $405,100 | $226,851 to $405,100 | $113,426 to $202,550 | $206,601 to $405,100 |

| 35% | $405,101 to $406,750 | $405,101 to $457,600 | $202,551 to $228,800 | $405,101 to $432,200 |

| 39.6% | $406,751 or more | $457,601 or more | $228,801 or more | $432,201 or more |

Read more: http://www.bankrate.com/finance/taxes/tax-brackets.aspx#ixzz3d5U58PUe

The last type of tax is a regressive tax which places the burden on those with lower incomes rather than those with higher incomes. For example if a person with an income of $20,000 purchases products in a state with a 4% sales tax, they will pay more of their income on products versus a person who's income is $100,000. Another example of a regressive tax is the FICA tax, which is less of a burden on someone who makes more money since the percentage declines as the income goes up.

Video: Regressive Tax

In the United States taxes are based on two concepts: the benefit principle of taxation and the ability-to-pay principle. The benefit principle is the idea that people who benefit from government goods should pay taxes in proportion to the number of benefits that they may receive. The basic problem with this concept is that the people who are in most needs of the government's programs are the least likely to be able to pay for those services. In addition, how can we measure those benefits? If there is a tax paid on air travel to improve the airport buildings, and the local restaurant near the airport benefits from that tax, should they have to pay for that benefit? Can there be a monetary value placed on externalities? Probably not. Therefore, the idea of the benefit principle of taxation is not a viable theory. The second concept, the ability-to-pay principle is the belief that people should pay taxes based on their ability to pay. If you make very little money, then you should pay less in taxes. If you make more money, then you should pay more in taxes. The belief is that people should pay according to how much they make or pay taxes on a marginal tax rate or a progressive tax rate.

Video: Tax Man Max

Answer the self check questions below to monitor your understanding of the concepts in this section.

Answer the self check questions below to monitor your understanding of the concepts in this section.Self Check Questions

- Explain how taxes can affect the economy. Give 4 examples of their impact.

- What is the purpose of a "sin tax"? Give an example.

- Research online to find out how high some sin taxes are in various states. Then research to see if the sin taxes do what they are supposed to do. What is taxed? Does it raise significant revenue? Has it changed consumer behavior?

- There is a belief that taxes affect productivity and growth. How is this possible?

- What is the incidence of a tax? Who does it impact? Give an example.

- What are the 3 criteria for effective taxes?

- Explain the "benefit principle of taxation." Explain 2 limits of the "benefit principle of taxation."

- Explain the "ability-to-pay principle of taxation."

- What are the 3 types of taxes?

- What is a proportional tax?

- What is a progressive tax? How does it work?

- Define regressive tax.

Image |

Reference | Attributions |

|

[Figure 2] | Credit: By Travürsa [GFDL (http://www.gnu.org/copyleft/fdl.html) or CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0/)], via Wikimedia Commons Source: https://commons.wikimedia.org/wiki/File:Cigarette_Tax_Per_State.svg License: CC BY-NC 3.0 |