3.11: Unemployment

- Page ID

- 1696

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Unemployment

Despite enormous growth in the size of the U.S. population and labor force in the twentieth-century, along with other major trends like globalization and new technology, the unemployment rate shows no long-term rising trend. Unemployment imposes high costs. Unemployed individuals suffer from loss of income and from stress. An economy with high unemployment suffers an opportunity cost of unused resources. The adult population can be divided into those in the labor force and those out of the labor force. In turn, those in the labor force are divided into employed and unemployed. A person without a job must be willing and able to work and actively looking for work to be counted as unemployed; otherwise, a person without a job is counted as being out of the labor force.

Universal Generalizations

- Frictional, structural, cyclical, seasonal, and technological are the different types of unemployment.

- Full employment is one of the seven economic and social goals of the U.S. economy.

- The unemployment rate is one of the most closely watched economic statistics in the U.S.

Guiding Questions

- How does the government collect data on the unemployment rate?

- What can the unemployment rate tell economists about the health of the U.S. economy?

- Why is the employment rate the hardest to maintain?

Introduction to Unemployment

Unemployment can be a terrible and wrenching life experience—like a serious automobile accident or a messy divorce—whose consequences can be fully understood only by someone who has gone through it. For unemployed individuals and their families, there is the day-to-day financial stress of not knowing where the next paycheck is coming from. There are painful adjustments, like watching your savings account dwindle, selling a car and buying a cheaper one, or moving to a less expensive place to live. Even when the unemployed person finds a new job, it may pay less than the previous one. For many people, their job is an important part of their self-worth. When unemployment separates people from the workforce, it can affect family relationships as well as mental and physical health.

The human costs of unemployment alone would justify making a low level of unemployment an important public policy priority. But unemployment also includes economic costs to the broader society. When millions of unemployed but willing workers cannot find jobs, an economic resource is going unused. An economy with high unemployment is like a company operating with a functional but unused factory. The opportunity cost of unemployment is the output that could have been produced by the unemployed workers.

This section will discuss how the unemployment rate is defined and computed. It will examine the patterns of unemployment over time, for the U.S. economy as a whole, for different demographic groups in the U.S. economy, and for other countries. It will then consider an economic explanation for unemployment, and how it explains the patterns of unemployment and suggests public policies for reducing it.

Video: The Fed Explained: Labor Force and Unemployment

How the Unemployment Rate is Defined and Computed

Unemployment is typically described in newspaper or television reports as a percentage or a rate. A recent report might have said, for example, from August 2009 to November 2009, the U.S. unemployment rate rose from 9.7% to 10.0%, but by June 2010, it had fallen to 9.5%. At a glance, the changes between the percentages may seem small. But remember that the U.S. economy has about 155 million adults who either have jobs or are looking for them. A rise or fall of just 0.1% in the unemployment rate of 155 million potential workers translates into 155,000 people, which is roughly the total population of a city like Syracuse, New York, Brownsville, Texas, or Pasadena, California. Large rises in the unemployment rate mean large numbers of job losses. The increase from 5% in April 2008 to 10% by November 2009 meant an additional 7.75 million people were looking for jobs but could not find them.

Who’s In or Out of the Labor Force?

Should everyone without a job be counted as unemployed? Of course not. Children, for example, should not be counted as unemployed. Surely, the retired should not be counted as unemployed. Many full-time college students have only a part-time job, or no job at all, but it seems inappropriate to count them as suffering the pains of unemployment. Some people are not working because they are rearing children, ill, on vacation, or on parental leave.

The point is that the adult population is not just divided into employed and unemployed. A third group exists: people who do not have a job, and for some reason—retirement, looking after children, taking a voluntary break before a new job—are not interested in having a job, either. It also includes those who do want a job but have quit looking, often due to being discouraged by their inability to find suitable employment. Economists refer to this third group of those who are not working and not looking for work as out of the labor force or not in the labor force.

The U.S. unemployment rate, which is based on a monthly survey carried out by the U.S. Bureau of the Census, asks a series of questions to divide up the adult population into employed, unemployed, or not in the labor force. To be classified as unemployed, a person must be without a job, currently available to work, and actively looking for work in the previous four weeks. Thus, a person who does not have a job but who is not currently available to work or has not actively looked for work in the last four weeks is counted as out of the labor force.

Employed: currently working for pay

Unemployed: Out of work and actively looking for a job

Out of the labor force: Out of paid work and not actively looking for a job

Labor force: the number of employed plus the unemployed

Calculating the Unemployment Rate

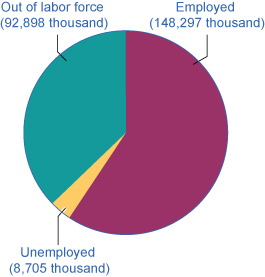

Figure 1 shows the three-way division of the over-16 adult population. In 2012, 63.7% of the adult population was “in the labor force;” that is, either employed or without a job but looking for work. Those in the labor force can be divided into the employed and the unemployed. These values are also shown in Table 1. The unemployment rate is not the percentage of the total adult population without jobs, but rather the percentage of adults who are in the labor force but who do not have jobs:

Unemployment rate = Unemployed people

Total labor force × 100

Employed, Unemployed, and Out of the Labor Force Distribution of Adult Population (age 16 and older), February 2015

The total adult, working-age population in February 2015 was 249.9 million. Out of this total population, 148.3 were classified as employed, and 8.7 million were classified as unemployed. The remaining 92.9 were classified as out of the labor force. As you will learn, however, this seemingly simple chart does not tell the whole story.

| Total adult population over the age of 16 | 249.9 million |

| In the labor force | 157 million (62.8%) |

| Employed | 148.3 million |

| Unemployed | 8.7 million |

| Out of the labor force | 92.9 million (37.2%) |

|

Table 1: U.S. Employment and Unemployment, 2015 (Source: www.bls.gov) |

In this example, the unemployment rate can be calculated as 8.7 million unemployed people divided by 157 million people in the labor force, which works out to a 5.5% rate of unemployment. The following Work It Out feature will walk you through the steps of this calculation.

So how do economists arrive at the percentages in and out of the labor force and the unemployment rate?

We will use the values in Table 1 to illustrate the steps.

To determine the percentage in the labor force:

Step 1. Divide the number of people in the labor force (157 million) by the total adult (working-age) population (249.9 million).

Step 2. Multiply by 100 to obtain the percentage.

-

Percentage in the labor force= 157/249.9 = 0.6282 or 62.8%

To determine the percentage out of the labor force:

Step 1. Divide the number of people out the labor force (92.9 million) by the total adult (working-age) population (249.9 million).

Step 2. Multiply by 100 to obtain the percentage.

- Percentage in the labor force= 92.9/249.9= 0.3717 or 37.2%

To determine the unemployment rate:

Step 1. Divide the number of unemployed people (8.7 million) by the total labor force (157 million).

Step 2. Multiply by 100 to obtain the rate.

- Unemployment Rate = 8.7/157= 0.0554 or 5.5%

Hidden Unemployment

Even with the “out of the labor force” category, there are still some people that are mislabeled in the categorization of employed, unemployed, or out of the labor force. There are some people who have only part-time or temporary jobs and who are looking for full time and permanent employment that are counted as employed, though they are not employed in the way they would like or need to be. Additionally, there are individuals who are underemployed. This includes those that are trained or skilled for one type or level of work who are working in a lower paying job or one that does not utilize their skills. For example, an individual with a college degree in finance who is working as a sales clerk would be considered underemployed. They are, however, also counted in the employed group. All of these individuals fall under the umbrella of the term “hidden unemployment.” Discouraged workers, those who have stopped looking for employment and, therefore, are no longer counted in the unemployed also fall into this group

Labor Force Participation Rate

Another important statistic is the labor force participation rate. This is the percentage of adults in an economy who are either employed or who are unemployed and looking for a job. So, using the data in Figure 1 and Table 1, those included in this calculation would be the 154.9 million individuals in the labor force. The rate is calculated by taking the number of people in the labor force, that is, the number employed and the number unemployed, divided by the total adult population and multiplying by 100 to get the percentage. For the data from 2012, the labor force participation rate is 63.7%. In the United States the labor force participation rate is usually around 67-68%.

The Establishment Payroll Survey

When the unemployment report comes out each month, the Bureau of Labor Statistics (BLS) also reports on the number of jobs created—which comes from the establishment payroll survey. The payroll survey is based on a survey of about 140,000 businesses and government agencies throughout the United States. It generates payroll employment estimates by the following criteria: all employees, average weekly hours worked, and average hourly, weekly, and overtime earnings. One of the criticisms of this survey is that it does not count the self-employed. It also does not make a distinction between new, minimum wage, part time or temporary jobs and full time jobs with “decent” pay.

The unemployment rate announced by the U.S. Bureau of Labor Statistics each month is based on the Current Population Survey (CPS), which has been carried out every month since 1940. Great care is taken to make this survey representative of the country as a whole. The country is first divided into 3,137 areas. The U.S. Bureau of the Census then selects 729 of these areas to survey. The 729 areas are then divided into districts of about 300 households each, and each district is divided into clusters of about four dwelling units. Every month, Census Bureau employees call about 15,000 of the four-household clusters, for a total of 60,000 households. Households are interviewed for four consecutive months, then rotated out of the survey for eight months, and then interviewed again for the same four months the following year, before leaving the sample permanently.

Based on this survey, unemployment rates are calculated by state, industry, urban and rural areas, gender, age, race or ethnicity, and level of education. A wide variety of other information is available, too. For example, how long have people been unemployed? Did they become unemployed because they quit, or were laid off, or their employer went out of business? Is the unemployed person the only wage earner in the family? The Current Population Survey is a treasure trove of information about employment and unemployment.

Criticisms of Measuring Unemployment

There are always complications in measuring the number of unemployed. For example, what about people who do not have jobs and would be available to work, but have gotten discouraged by the lack of available jobs in their area and stopped looking? Such people, and their families, may be suffering the pains of unemployment. But the survey counts them as out of the labor force because they are not actively looking for work. Other people may tell the Census Bureau that they are ready to work and looking for a job but, truly, they are not that eager to work and are not looking very hard at all. They are counted as unemployed, although they might more accurately be classified as out of the labor force. Still, other people may have a job, perhaps doing something like yard work, child care, or cleaning houses, but are not reporting the income earned to the tax authorities. They may report being unemployed when they are actually working.

Although the unemployment rate gets most of the public and media attention, economic researchers at the Bureau of Labor Statistics publish a wide array of surveys and reports that try to measure these kinds of issues and to develop a more nuanced and complete view of the labor market. It is not exactly a hot news flash that economic statistics are imperfect. Even imperfect measures like the unemployment rate, however, can still be quite informative, when interpreted knowledgeably and sensibly.

Unemployment imposes high costs. Unemployed individuals suffer from loss of income and from stress. An economy with high unemployment suffers an opportunity cost of unused resources. The adult population can be divided into those in the labor force and those out of the labor force. In turn, those in the labor force are divided into employed and unemployed. A person without a job must be willing and able to work and actively looking for work to be counted as unemployed; otherwise, a person without a job is counted as being out of the labor force. The unemployment rate is defined as the number of unemployed persons divided by the number of persons in the labor force (not the overall adult population). The Current Population Survey (CPS) conducted by the United States Census Bureau measures the percentage of the labor force that is unemployed. The establishment payroll survey by the Bureau of Labor Statistics measures the net change in jobs created for the month.

Patterns of Unemployment

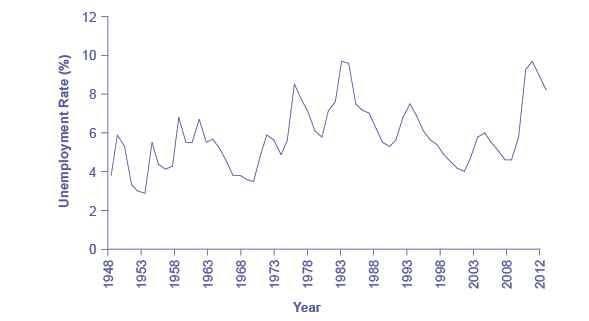

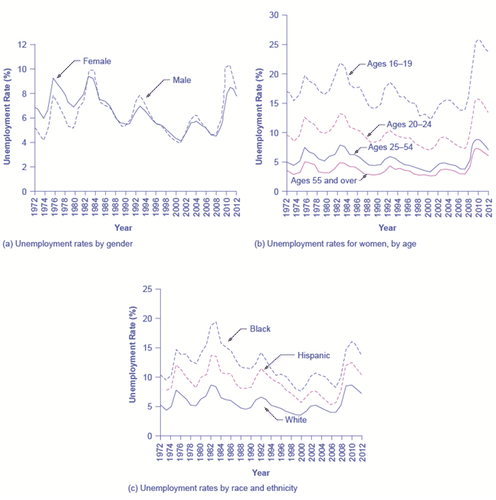

Let’s look at how unemployment rates have changed over time and how various groups of people are affected by unemployment differently. Figure 2 shows the historical pattern of U.S. unemployment 1948–2012.

Historical U.S. Unemployment Rate

The U.S. unemployment rate moves up and down as the economy moves in and out of recessions. But over time, the unemployment rate seems to return to a range of 4% to 6%. There does not seem to be a long-term trend toward the rate moving generally higher or generally lower. (Source: www.census.gov/cps)

As we look at this data, several patterns stand out:

1) Unemployment rates do fluctuate over time. During the deep recessions of the early 1980s and of 2007–2009, unemployment reached roughly 10%. For comparison, during the Great Depression of the 1930s, the unemployment rate reached almost 25% of the labor force.

2) Unemployment rates in the late 1990s and into the mid-2000s were rather low by historical standards. The unemployment rate was below 5% from 1997 to 2000 and near 5% during almost all of 2006–2007. The previous time unemployment had been less than 5% for three consecutive years was three decades earlier, from 1968 to 1970.

3) The unemployment rate never falls all the way to zero. Indeed, it never seems to get below 3%—and it stays that low only for very short periods. (Reasons why this is the case will be discussed later.)

4) The timing of rises and falls in unemployment matches fairly well with the timing of upswings and downswings in the overall economy. During periods of recession and depression, unemployment is high. During periods of economic growth, unemployment tends to be lower.

5) No significant upward or downward trend in unemployment rates is apparent. This point is especially worth noting because the U.S. population nearly quadrupled from 76 million in 1900 to over 314 million by 2012. Moreover, a higher proportion of U.S. adults are now in the paid workforce, because women have entered the paid labor force in significant numbers in recent decades. Women composed 18% of the paid workforce in 1900 and nearly half of the paid workforce in 2012. But despite the increased number of workers, as well as other economic events like globalization and the continuous invention of new technologies, the economy has provided jobs without causing any long-term upward or downward trend in unemployment rates.

Unemployment Rates by Group

Unemployment is not distributed evenly across the U.S. population. Figure 3 shows unemployment rates broken down in various ways: by gender, age, and race/ethnicity.

Unemployment Rate by Demographic Group

(a) By gender, 1972–2012. Unemployment rates for men used to be lower than unemployment rates for women, but in recent decades, the two rates have been very close, often with the unemployment rate for men somewhat higher. (b) By age, 1972–2012. Unemployment rates are highest for the very young and become lower with age. (c) By race and ethnicity, 1972–2012. Although unemployment rates for all groups tend to rise and fall together, the unemployment rate for whites has been lower than the unemployment rate for blacks and Hispanics in recent decades. (Source: www.bls.gov)

The unemployment rate for women had historically tended to be higher than the unemployment rate for men, perhaps reflecting the historical pattern that women were seen as “secondary” earners. By about 1980, however, the unemployment rate for women was essentially the same as that for men, as shown in Figure 3 (a). During the recession of 2008–2009, however, the unemployment rate climbed higher for men than for women.

Younger workers tend to have higher unemployment, while middle-aged workers tend to have lower unemployment, probably because the middle-aged workers feel the responsibility of needing to have a job more heavily. Younger workers move in and out of jobs (and in and out of the labor force) more easily. Elderly workers have extremely low rates of unemployment, because those who do not have jobs often exit the labor force by retiring, and thus are not counted in the unemployment statistics. Figure 3 (b) shows unemployment rates for women divided by age; the pattern for men is similar.

The unemployment rate for African-Americans is substantially higher than the rate for other racial or ethnic groups, a fact that reflects, to some extent, a pattern of discrimination that has constrained blacks’ labor market opportunities. However, the gaps between unemployment rates for whites and for blacks and Hispanics diminished in the 1990s, as shown in Figure 3 (c). In fact, unemployment rates for blacks and Hispanics were at the lowest levels for several decades in the mid-2000s before rising during the recent Great Recession.

Finally, those with less education typically suffer higher unemployment. In early 2013, for example, the unemployment rate for those with a college degree was 3.7%; for those with some college but not a four-year degree, the unemployment rate was 6.0%; for high school graduates with no additional degree, the unemployment rate was 7.6%; and for those without a high school diploma, the unemployment rate was 10.3%. This pattern may arise because additional education offers better connections to the labor market and higher demand, or it may occur because the labor market opportunities for low-skilled workers are less attractive than the opportunities for the more highly-skilled. Because of lower pay, low-skilled workers may be less motivated to find jobs.

Breaking Down Unemployment in Other Ways

The Bureau of Labor Statistics also gives information about the reasons for being unemployed as well as the length of time individuals have been unemployed. Table 3, for example, shows the four reasons for being unemployed and the percentages of the currently unemployed that fall into each category. Table 4 shows the length of unemployment. For both of these, the data is from May of 2013. (bls.gov)

| Reason | Percentage |

| New Entrants | 10.8% |

| Re-entrants | 28.5% |

| Job Leavers | 8.1% |

| Job Losers: Temporary | 8.5% |

| Job Losers: Non Temporary | 44.1% |

| Length of Time | Percentage |

| Under 5 weeks | 23.2% |

| 5 to 14 weeks | 22.8% |

| 15 to 26 weeks | 16.7% |

| Over 27 weeks | 37.3% |

International Unemployment Comparisons

From an international perspective, the U.S. unemployment rate typically has looked a little better than average. Table 5 compares unemployment rates for 1991, 1996, 2001, 2006 (just before the recession), and 2011 (somewhat after the recession) from several other high-income countries.

| Country | 1991 | 1996 | 2001 | 2006 | 2012 |

| United States | 6.8% | 5.4% | 4.8% | 4.4% | 8.1% |

| Canada | 9.8% | 8.8% | 6.4% | 6.2% | 6.3% |

| Japan | 2.1% | 3.4% | 5.1% | 4.5% | 3.9% |

| France | 9.5% | 12.5% | 8.7% | 10.1% | 10.0% |

| Germany | 5.6% | 9.0% | 8.9% | 9.8% | 5.5% |

| Italy | 6.9% | 11.7% | 9.6% | 7.8% | 10.8% |

| Sweden | 3.1% | 9.9% | 5.0% | 5.2% | 7.9% |

| United Kingdom | 8.8% | 8.1% | 5.1% | 5.5% | 8.0% |

However, cross-country comparisons of unemployment rates need to be treated with care, because each country has slightly different survey tools for measuring unemployment and also different labor markets. For example, Japan’s unemployment rates appear quite low, but Japan’s economy has been mired in slow growth and recession since the late 1980s, and Japan’s unemployment rate probably paints too rosy a picture of its labor market. In Japan, workers who lose their jobs are often quick to exit the labor force and not look for a new job, in which case they are not counted as unemployed. In addition, Japanese firms are often quite reluctant to fire workers, and so firms have substantial numbers of workers who are on reduced hours or officially employed but doing very little. This Japanese pattern is perhaps best viewed as an unusual method for society to provide support for the unemployed, rather than a sign of a healthy economy.

Comparing unemployment rates in the United States and other high-income economies with unemployment rates in Latin America, Africa, Eastern Europe, and Asia is very difficult. One reason is that the statistical agencies in many poorer countries lack the resources and technical capabilities of the U.S. Bureau of the Census. But a more difficult problem with international comparisons is that in many low-income countries, most workers are not involved in the labor market through an employer who pays them regularly. Instead, workers in these countries are engaged in short-term work, subsistence activities, and barter. Moreover, the effect of unemployment is very different in high-income and low-income countries. Unemployed workers in the developed economies have access to various government programs like unemployment insurance, welfare, and food stamps; such programs may barely exist in poorer countries. Although unemployment is a serious problem in many low-income countries, it manifests itself in a different way than in high-income countries.

The U.S. unemployment rate rises during periods of recession and depression but falls back to the range of 4% to 6% when the economy is strong. The unemployment rate never falls to zero. Despite enormous growth in the size of the U.S. population and labor force in the twentieth century, along with other major trends like globalization and new technology, the unemployment rate shows no long-term rising trend.

Unemployment rates differ by group: higher for African-Americans and Hispanics than for whites; higher for less educated than more educated; higher for the young than the middle-aged. Women’s unemployment rates used to be higher than men’s, but in recent years men’s and women’s unemployment rates have been very similar. In recent years, unemployment rates in the United States have compared favorably with unemployment rates in most other high-income economies.

What Causes Changes in Unemployment over the Short Run

We have seen that unemployment varies across times and places. What causes changes in unemployment? There are different answers in the short run and in the long run. Let's look at the short run first.

Cyclical Unemployment

Let’s make the plausible assumption that in the short run, from a few months to a few years, the quantity of hours that the average person is willing to work for a given wage does not change much, so the labor supply curve does not shift much. In addition, make the standard ceteris paribus assumption that there is no substantial short-term change in the age structure of the labor force, institutions and laws affecting the labor market, or other possibly relevant factors.

One primary determinant of the demand for labor from firms is how they perceive the state of the macroeconomy. If firms believe that business is expanding, then at any given wage they will desire to hire a greater quantity of labor, and the labor demand curve shifts to the right. Conversely, if firms perceive that the economy is slowing down or entering a recession, then they will wish to hire a lower quantity of labor at any given wage, and the labor demand curve will shift to the left. The variation in unemployment caused by the economy moving from expansion to recession or from recession to expansion (i.e. the business cycle) is known as cyclical unemployment.

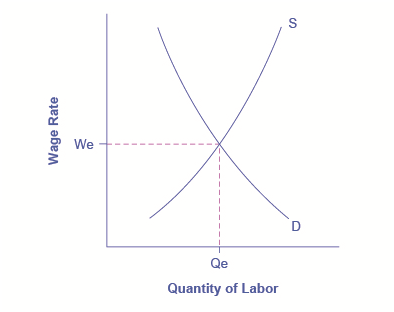

From the standpoint of the supply-and-demand model of competitive and flexible labor markets, unemployment represents something of a puzzle. In a supply-and-demand model of a labor market, as illustrated in Figure 4, the labor market should move toward an equilibrium wage and quantity. At the equilibrium wage (We), the equilibrium quantity (Qe) of labor supplied by workers should be equal to the quantity of labor demanded by employers.

The Unemployment and Equilibrium in the Labor Market

In a labor market with flexible wages, the equilibrium will occur at wage We and quantity Qe, where the number of people looking for jobs (shown by S) equals the number of jobs available (shown by D).

One possibility for unemployment is that people who are unemployed are those who are not willing to work at the current equilibrium wage, say $10 an hour, but would be willing to work at a higher wage, like $20 per hour. The monthly Current Population Survey would count these people as unemployed, because they say they are ready and looking for work (at $20 per hour). But from an economist’s point of view, these people are choosing to be unemployed.

Probably a few people are unemployed because of unrealistic expectations about wages, but they do not represent the majority of the unemployed. Instead, unemployed people often have friends or acquaintances of similar skill levels who are employed, and the unemployed would be willing to work at the jobs and wages similar to what is being received by those people. But the employers of their friends and acquaintances do not seem to be hiring. In other words, these people are involuntarily unemployed. What causes involuntary unemployment?

Why Wages Might Be "Sticky Downward"

If a labor market model with flexible wages does not describe unemployment very well—because it predicts that anyone willing to work at the going wage can always find a job—then it may prove useful to consider economic models in which wages are not flexible or adjust only very slowly. In particular, even though wage increases may occur with relative ease, wage decreases are few and far between.

One set of reasons why wages may be “sticky downward,” as economists put it, involves economic laws and institutions. For low-skilled workers being paid the minimum wage, it is illegal to reduce their wages. For union workers operating under a multiyear contract with a company, wage cuts might violate the contract and create a labor dispute or a strike. However, minimum wages and union contracts are not a sufficient reason why wages would be sticky downward for the U.S. economy as a whole. After all, out of the 150 million or so workers in the U.S. economy, only about 1.4 million—less than 2% of the total—are paid the minimum wage. Similarly, only about 12% of American wage and salary workers are represented by a labor union. In other high-income countries, more workers may have their wages determined by unions or the minimum wage may be set at a level that applies to a larger share of workers. For the United States, however, these two factors combined affect only about one-fifth or less of the labor force.

Economists looking for reasons why wages might be sticky downward have focused on factors that may characterize most labor relationships in the economy, not just a few. A number of different theories have been proposed, but they share a common tone.

One argument is that even employees who are not union members often work under an implicit contract, which is that the employer will try to keep wages from falling when the economy is weak or the business is having trouble, and the employee will not expect huge salary increases when the economy or the business is strong. This wage-setting behavior acts like a form of insurance: the employee has some protection against wage declines in bad times, but pays for that protection with lower wages in good times. Clearly, this sort of implicit contract means that firms will be hesitant to cut wages, lest workers feel betrayed and work less hard or even leave the firm.

Efficiency wage theory argues that the productivity of workers depends on their pay, and so employers will often find it worthwhile to pay their employees somewhat more than market conditions might dictate. One reason is that employees who are paid better than others will be more productive because they recognize that if they were to lose their current jobs, they would suffer a decline in salary. As a result, they are motivated to work harder and to stay with the current employer. In addition, employers know that it is costly and time-consuming to hire and train new employees, so they would prefer to pay workers a little extra now rather than to lose them and have to hire and train new workers. Thus, by avoiding wage cuts, the employer minimizes costs of training and hiring new workers, and reaps the benefits of well-motivated employees.

The adverse selection of wage cuts argument points out that if an employer reacts to poor business conditions by reducing wages for all workers, then the best workers, those with the best employment alternatives at other firms, are the most likely to leave. The least attractive workers, with fewer employment alternatives, are more likely to stay. Consequently, firms are more likely to choose which workers should depart, through layoffs and firings, rather than trimming wages across the board. Sometimes companies that are going through tough times can persuade workers to take a pay cut for the short term and still retain most of the firm’s workers. But these stories are notable because they are so uncommon. It is far more typical for companies to lay off some workers rather than to cut wages for everyone.

The insider-outsider model of the labor force, in simple terms, argues that those already working for firms are “insiders,” while new employees, at least for a time, are “outsiders.” A firm depends on its insiders to grease the wheels of the organization, to be familiar with routine procedures, to train new employees, and so on. However, cutting wages will alienate the insiders and damage the firm’s productivity and prospects.

Finally, the relative wage coordination argument points out that even if most workers were hypothetically willing to see a decline in their own wages in bad economic times as long as everyone else also experiences such a decline, there is no obvious way for a decentralized economy to implement such a plan. Instead, workers confronted with the possibility of a wage cut will worry that other workers will not have such a wage cut, and so a wage cut means being worse off both in absolute terms and relative to others. As a result, workers fight hard against wage cuts.

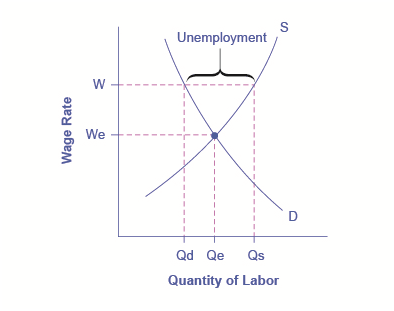

These theories of why wages tend not to move downward differ in their logic and their implications, and figuring out the strengths and weaknesses of each theory is an ongoing subject of research and controversy among economists. All tend to imply that wages will decline only very slowly, if at all, even when the economy or a business is having tough times. When wages are inflexible and unlikely to fall, then either short-run or long-run unemployment can result. This can be seen in Figure 5.

Sticky Wages in the Labor Market

Because the wage rate is stuck at W, above the equilibrium, the number of job seekers (Qs) is greater than the number of job openings (Qd). The result is unemployment, shown by the bracket in the figure.

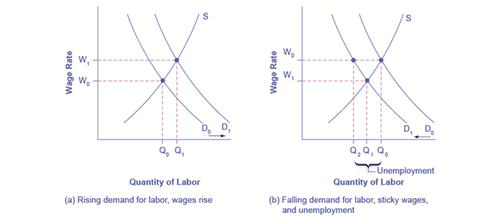

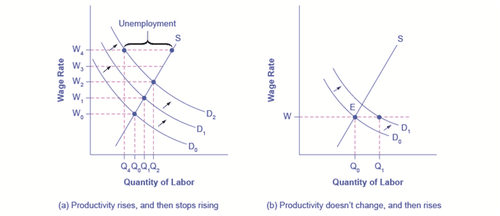

The interaction between shifts in labor demand and wages that are sticky downward are shown in Figure 6.

Figure 6 (a) illustrates the situation in which the demand for labor shifts to the right from D0 to D1. In this case, the equilibrium wage rises from W0 to W1 and the equilibrium quantity of labor hired increases from Q0 to Q1. It does not hurt employee morale at all for wages to rise.

Figure 6 (b) shows the situation in which the demand for labor shifts to the left, from D0 to D1, as it would tend to do in a recession. Because wages are sticky downward, they do not adjust toward what would have been the new equilibrium wage (Q1), at least not in the short run. Instead, after the shift in the labor demand curve, the same quantity of workers is willing to work at that wage as before; however, the quantity of workers demanded at that wage has declined from the original equilibrium (Q0) to Q2. The gap between the original equilibrium quantity (Q0) and the new quantity demanded of labor (Q2) represents workers who would be willing to work at the going wage but cannot find jobs. The gap represents the economic meaning of unemployment.

Rising Wage and Low Unemployment: Where Is the Unemployment in Supply and Demand?

(a) In a labor market where wages are able to rise, an increase in the demand for labor from D0 to D1 leads to an increase in equilibrium quantity of labor hired from Q0 to Q1 and a rise in the equilibrium wage from W0 to W1. (b) In a labor market where wages do not decline, a fall in the demand for labor from D0 to D1 leads to a decline in the quantity of labor demanded at the original wage (W0) from Q0 to Q2. These workers will want to work at the prevailing wage (W0), but will not be able to find jobs.

This analysis helps to explain the connection noted earlier: that unemployment tends to rise in recessions and to decline during expansions. The overall state of the economy shifts the labor demand curve and, combined with wages that are sticky downward, unemployment changes. The rise in unemployment that occurs because of a recession is cyclical unemployment.

Cyclical unemployment rises and falls with the business cycle. In a labor market with flexible wages, wages will adjust in such a market so that quantity demanded of labor always equals the quantity supplied of labor at the equilibrium wage. Many theories have been proposed for why wages might not be flexible, but instead may adjust only in a “sticky” way, especially when it comes to downward adjustments: implicit contracts, efficiency wage theory, adverse selection of wage cuts, insider-outsider model, and relative wage coordination.

What Causes Changes in Unemployment over the Long Run

Cyclical unemployment explains why unemployment rises during a recession and falls during an economic expansion. But what explains the remaining level of unemployment even during good economic times? Why is the unemployment rate never zero? Even when the U.S. economy is growing strongly, the unemployment rate only rarely dips as low as 4%. Moreover, the discussion earlier pointed out that unemployment rates in many European countries like Italy, France, and Germany have often been remarkably high at various times in the last few decades. Why does some level of unemployment persist even when economies are growing strongly? Why are unemployment rates continually higher in certain economies, through good economic years and bad? Economists have a term to describe the remaining level of unemployment that occurs even when the economy is healthy: it is called the natural rate of unemployment.

The Long Run: The Natural Rate of Unemployment

The natural rate of unemployment is not “natural” in the sense that water freezes at 32 degrees Fahrenheit or boils at 212 degrees Fahrenheit. It is not a physical and unchanging law of nature. Instead, it is only the “natural” rate because it is the unemployment rate that would result from the combination of economic, social, and political factors that exist at a time—assuming the economy was neither booming nor in recession. These forces include the usual pattern of companies expanding and contracting their workforces in a dynamic economy, social and economic forces that affect the labor market, or public policies that affect either the eagerness of people to work or the willingness of businesses to hire. Let’s discuss these factors in more detail.

Frictional Unemployment

In a market economy, some companies are always going broke for a variety of reasons: old technology; poor management; good management that happened to make bad decisions; shifts in tastes of consumers so that less of the firm’s product is desired; a large customer who went broke; or tough domestic or foreign competitors. Conversely, other companies will be doing very well for just the opposite reasons and looking to hire more employees. In a perfect world, all of those who lost jobs would immediately find new ones. But in the real world, even if the number of job seekers is equal to the number of job vacancies, it takes time to find out about new jobs, to interview and figure out if the new job is a good match, or perhaps to sell a house and buy another in proximity to a new job. The unemployment that occurs in the meantime, as workers move between jobs, is called frictional unemployment. Frictional unemployment is not inherently a bad thing. It takes time on the part of both the employer and the individual to match those looking for employment with the correct job openings. For individuals and companies to be successful and productive, you want people to find the job for which they are best suited, not just the first job offered.

In the mid-2000s, before the recession of 2008–2009, it was true that about 7% of U.S. workers saw their jobs disappear in any three-month period. But in periods of economic growth, these destroyed jobs are counterbalanced for the economy as a whole by a larger number of jobs created. In 2005, for example, there were typically about 7.5 million unemployed people at any given time in the U.S. economy. Even though about two-thirds of those unemployed people found a job in 14 weeks or fewer, the unemployment rate did not change much during the year, because those who found new jobs were largely offset by others who lost jobs.

Of course, it would be preferable if people who were losing jobs could immediately and easily move into the new jobs being created, but in the real world, that is not possible. Someone who is laid off by a textile mill in South Carolina cannot turn around and immediately start working for a textile mill in California. Instead, the adjustment process happens in ripples. Some people find new jobs near their old ones, while others find that they must move to new locations. Some people can do a very similar job with a different company, while others must start new career paths. Some people may be near retirement and decide to look only for part-time work, while others want an employer that offers a long-term career path. The frictional unemployment that results from people moving between jobs in a dynamic economy may account for one to two percentage points of total unemployment.

The level of frictional unemployment will depend on how easy it is for workers to learn about alternative jobs, which may reflect the ease of communications about job prospects in the economy. The extent of frictional unemployment will also depend to some extent on how willing people are to move to new areas to find jobs—which in turn may depend on history and culture.

Frictional unemployment and the natural rate of unemployment also seem to depend on the age distribution of the population. [This graph] (b) showed that unemployment rates are typically lower for people between 25–54 years of age than they are for those who are either younger or older. “Prime-age workers,” as those in the 25–54 age bracket are sometimes called, are typically at a place in their lives when they want to have a job and income arriving at all times. But some proportion of those who are under 30 may still be trying out jobs and life options and some proportion of those over 55 are eyeing retirement. In both cases, the relatively young or old tend to worry less about unemployment than those in-between, and their periods of frictional unemployment may be longer as a result. Thus, a society with a relatively high proportion of relatively young or old workers will tend to have a higher unemployment rate than a society with a higher proportion of its workers in middle age.

Structural Unemployment

Another factor that influences the natural rate of unemployment is the amount of structural unemployment. The structurally unemployed are individuals who have no jobs because they lack skills valued by the labor market, either because demand has shifted away from the skills they do have, or because they never learned any skills. An example of the former would be the unemployment among aerospace engineers after the U.S. space program downsized in the 1970s. An example of the latter would be high school dropouts.

Some people worry that technology causes structural unemployment. In the past, new technologies have put lower skilled employees out of work, but at the same time they create demand for higher skilled workers to use the new technologies. Education seems to be the key in minimizing the amount of structural unemployment. Individuals who have degrees can be retrained if they become structurally unemployed. For people with no skills and little education, that option is more limited.

Natural Unemployment and Potential Real GDP

The natural unemployment rate is related to two other important concepts: full employment and potential real GDP. The economy is considered to be at full employment when the actual unemployment rate is equal to the natural unemployment. When the economy is at full employment, real GPD is equal to potential real GDP. By contrast, when the economy is below full employment, the unemployment rate is greater than the natural unemployment rate and real GDP is less than potential. Finally, when the economy above full employment, then the unemployment rate is less than the natural unemployment rate and real GDP is greater than potential. Operating above potential is only possible for a short while, since it is analogous to all workers working overtime.

Productivity Shifts and the Natural Rate of Unemployment

Unexpected shifts in productivity can have a powerful effect on the natural rate of unemployment. Over time, the level of wages in an economy will be determined by the productivity of workers. After all, if a business paid workers more than could be justified by their productivity, the business will ultimately lose money and go bankrupt. Conversely, if a business tries to pay workers less than their productivity then, in a competitive labor market, other businesses will find it worthwhile to hire away those workers and pay them more.

However, adjustments of wages to productivity levels will not happen quickly or smoothly. Wages are typically reviewed only once or twice a year. In many modern jobs, it is difficult to measure productivity at the individual level. For example, how precisely would one measure the quantity produced by an accountant who is one of many people working in the tax department of a large corporation? Because productivity is difficult to observe, wage increases are often determined based on recent experience with productivity; if productivity has been rising at, say, 2% per year, then wages rise at that level as well. However, when productivity changes unexpectedly, it can affect the natural rate of unemployment for a time.

The U.S. economy in the 1970s and 1990s provides two vivid examples of this process. In the 1970s, productivity growth slowed down unexpectedly. For example, output per hour of U.S. workers in the business sector increased at an annual rate of 3.3% per year from 1960 to 1973, but only 0.8% from 1973 to 1982. Figure 7 (a) illustrates the situation where the demand for labor—that is, the quantity of labor that business is willing to hire at any given wage—has been shifting out a little each year because of rising productivity, from D0 to D1 to D2. As a result, equilibrium wages have been rising each year from W0 to W1 to W2. But when productivity unexpectedly slows down, the pattern of wage increases does not adjust right away. Wages keep rising each year from W2 to W3 to W4. But the demand for labor is no longer shifting up. A gap opens where the quantity of labor supplied at wage level W4 is greater than the quantity demanded. The natural rate of unemployment rises; indeed, in the aftermath of this unexpectedly low productivity in the 1970s, the national unemployment rate did not fall below 7% from May, 1980 until 1986. Over time, the rise in wages will adjust to match the slower gains in productivity, and the unemployment rate will ease back down, but this process may take years.

Unexpected Productivity Changes and Unemployment

(a) Productivity is rising, increasing the demand for labor. Employers and workers become used to the pattern of wage increases. Then productivity suddenly stops increasing. However, the expectations of employers and workers for wage increases do not shift immediately, so wages keep rising as before. But the demand for labor has not increased, so at wage W4, unemployment exists where the quantity supplied of labor exceeds the quantity demanded. (b) The rate of productivity increase has been zero for a time, so employers and workers have come to accept the equilibrium wage level (W). Then productivity increases unexpectedly, shifting demand for labor from D0 to D1. At the wage (W), this means that the quantity demanded of labor exceeds the quantity supplied, and with job offers plentiful, the unemployment rate will be low.

The late 1990s provide an opposite example: instead of the surprise decline in productivity in the 1970s, productivity unexpectedly rose in the mid-1990s. The annual growth rate of real output per hour of labor increased from 1.7% from 1980–1995, to an annual rate of 2.6% from 1995–2001. Let’s simplify the situation a bit, so that the economic lesson of the story is easier to see graphically, and say that productivity had not been increasing at all in earlier years, so the intersection of the labor market was at point E in Figure 7 (b), where the demand curve for labor (D0) intersects the supply curve for labor. As a result, real wages were not increasing. Now, productivity jumps upward, which shifts the demand for labor out to the right, from D0 to D1. At least for a time, however, wages are still being set according to the earlier expectations of no productivity growth, so wages do not rise. The result is that at the prevailing wage level (W), the quantity of labor demanded (Qd) will for a time exceed the quantity of labor supplied (Qs), and unemployment will be very low—actually below the natural level of unemployment for a time. This pattern of unexpectedly high productivity helps to explain why the unemployment rate stayed below 4.5%—quite a low level by historical standards—from 1998 until after the U.S. economy had entered a recession in 2001.

Average levels of unemployment will tend to be somewhat higher on average when productivity is unexpectedly low, and conversely, will tend to be somewhat lower on average when productivity is unexpectedly high. But over time, wages do eventually adjust to reflect productivity levels.

Public Policy and the Natural Rate of Unemployment

Public policy can also have a powerful effect on the natural rate of unemployment. On the supply side of the labor market, public policies to assist the unemployed can affect how eager people are to find work. For example, if a worker who loses a job is guaranteed a generous package of unemployment insurance, welfare benefits, food stamps, and government medical benefits, then the opportunity cost of being unemployed is lower and that worker will be less eager to seek a new job.

What seems to matter most is not just the amount of these benefits, but how long they last. A society that provides generous help for the unemployed that cuts off after, say, six months, may provide less of an incentive for unemployment than a society that provides less generous help that lasts for several years. Conversely, government assistance for job search or retraining can in some cases encourage people back to work sooner.

Video: Unemployment Compensation

How Does U.S. Unemployment Insurance Work?

Unemployment insurance is a joint federal-state program, established by federal law in 1935. The federal government sets minimum standards for the program, but most of the administration is done by state governments.

The funding for the program is a federal tax collected from employers. The federal government requires that the tax be collected on the first $7,000 in wages paid to each worker; however, states can choose to collect the tax on a higher amount if they wish, and 41 states have set a higher limit. States can choose the length of time that benefits will be paid, although most states limit unemployment benefits to 26 weeks—with extensions possible in times of, especially high unemployment. The fund is then used to pay benefits to those who become unemployed. Average unemployment benefits are equal to about one-third of the wage earned by the person in his or her previous job, but the level of unemployment benefits varies considerably across states.

| Bottom 10 States that pay the Lowest | Benefit per Week | Top 10 States that pay the Highest | Benefit per week |

| Georgia | $330 | Massachusetts | $653 |

| South Carolina | $326 | Washington | $604 |

| Missouri | $320 | New Jersey | $600 |

| South Dakota | $295 | Minnesota | $585 |

| Florida | $275 | Pennsylvania | $573 |

| Tennessee | $275 | Rhode Island | $566 |

| Alabama | $265 | Hawaii | $560 |

| Louisiana | $258 | Connecticut | $555 |

| Arizona | $240 | Ohio | $524 |

| Mississippi | $235 | Oregon | $507 |

One other interesting thing to note about the classifications of unemployment—an individual does not have to collect unemployment benefits to be classified as unemployed. While there are statistics kept and studied relating to how many people are collecting unemployment insurance, this is not the source of unemployment rate information.

On the demand side of the labor market, government rules social institutions, and the presence of unions can affect the willingness of firms to hire. For example, if a government makes it hard for businesses to start up or to expand, by wrapping new businesses in bureaucratic red tape, then businesses will become more discouraged about hiring. Government regulations can make it harder to start a business by requiring that a new business obtain many permits and pay many fees, or by restricting the types and quality of products that can be sold. Other government regulations, like zoning laws, may limit where business can be done, or whether businesses are allowed to be open during evenings or on Sunday.

Whatever defenses may be offered for such laws in terms of social value—like the value some Christians place on not working on Sunday—these kinds of restrictions impose a barrier between some willing workers and other willing employers, and thus contribute to a higher natural rate of unemployment. Similarly, if the government makes it difficult to fire or lay off workers, businesses may react by trying not to hire more workers than strictly necessary—since laying these workers off would be costly and difficult. High minimum wages may discourage businesses from hiring low-skill workers. Government rules may encourage and support powerful unions, which can then push up wages for union workers, but at a cost of discouraging businesses from hiring those workers.

The Natural Rate of Unemployment in Recent Years

The underlying economic, social, and political factors that determine the natural rate of unemployment can change over time, which means that the natural rate of unemployment can change over time, too.

Estimates by economists of the natural rate of unemployment in the U.S. economy in the early 2000s run at about 4.5 to 5.5%. This is a lower estimate than earlier. Three of the common reasons proposed by economists for this change are outlined below.

1) The Internet has provided a remarkable new tool through which job seekers can find out about jobs at different companies and can make contact with relative ease. An Internet search is far easier than trying to find a list of local employers and then hunting up phone numbers for all of their human resources departments, requesting a list of jobs and application forms, and so on. Social networking sites such as LinkedIn have changed how people find work as well.

2) The growth of the temporary worker industry has probably helped to reduce the natural rate of unemployment. In the early 1980s, only about 0.5% of all workers held jobs through temp agencies; by the early 2000s, the figure had risen above 2%. Temp agencies can provide jobs for workers while they are looking for permanent work. They can also serve as a clearinghouse, helping workers find out about jobs with certain employers and getting a tryout with the employer. For many workers, a temp job is a stepping-stone to a permanent job that they might not have heard about or gotten any other way, so the growth of temp jobs will also tend to reduce frictional unemployment.

3) The aging of the “baby boom generation”—the especially large generation of Americans born between 1946 and 1963—meant that the proportion of young workers in the economy was relatively high in the 1970s, as the boomers entered the labor market, but is relatively low today. As noted earlier, middle-aged workers are far more likely to keep steady jobs than younger workers, a factor that tends to reduce the natural rate of unemployment.

The combined result of these factors is that the natural rate of unemployment was on average lower in the 1990s and the early 2000s than in the 1980s. The Great Recession of 2008–2009 pushed monthly unemployment rates above 10% in late 2009. But even at that time, the Congressional Budget Office was forecasting that by 2015, unemployment rates would fall back to about 5%.

The Natural Rate of Unemployment in Europe

By the standards of other high-income economies, the natural rate of unemployment in the U.S. economy appears relatively low. Through good economic years and bad, many European economies have had unemployment rates hovering near 10%, or even higher, since the 1970s. European rates of unemployment have been higher not because recessions in Europe have been deeper, but rather because the conditions underlying supply and demand for labor have been different in Europe, in a way that has created a much higher natural rate of unemployment.

Many European countries have a combination of generous welfare and unemployment benefits, together with nests of rules that impose additional costs on businesses when they hire. In addition, many countries have laws that require firms to give workers months of notice before laying them off and to provide substantial severance or retraining packages after laying them off. The legally required notice before laying off a worker can be more than three months in Spain, Germany, Denmark, and Belgium, and the legally required severance package can be as high as a year’s salary or more in Austria, Spain, Portugal, Italy, and Greece. Such laws will surely discourage laying off or firing current workers. But when companies know that it will be difficult to fire or lay off workers, they also become hesitant about hiring in the first place.

The typically higher levels of unemployment in many European countries in recent years, which have prevailed even when economies are growing at a solid pace, are attributable to the fact that the sorts of laws and regulations that lead to a high natural rate of unemployment are much more prevalent in Europe than in the United States.

A Preview of Policies to Fight Unemployment

The remedy for unemployment will depend on the diagnosis. Cyclical unemployment is a short-term problem, caused because the economy is in a recession. Thus, the preferred solution will be to avoid or minimize recessions. This policy can be enacted by stimulating the overall buying power in the economy so that firms perceive that sales and profits are possible, which makes them eager to hire.

Dealing with the natural rate of unemployment is trickier. There is not much to be done about the fact that in a market-oriented economy, firms will hire and fire workers. Nor is there much to be done about how the evolving age structure of the economy, or unexpected shifts in productivity, will affect the natural rate of unemployment for a time. However, as the example of high ongoing unemployment rates for many European countries illustrates, government policy clearly can affect the natural rate of unemployment that will persist even when GDP is growing.

When a government enacts policies that will affect workers or employers, it must examine how these policies will affect the information and incentives employees and employers have to seek each other out. For example, the government may have a role to play in helping some of the unemployed with job searches. The design of government programs that offer assistance to unemployed workers and protections to employed workers may need to be rethought so that they will not unduly discourage the supply of labor. Similarly, rules that make it difficult for businesses to begin or to expand may need to be redesigned so that they will not unduly discourage the demand for labor. The message is not that all laws affecting labor markets should be repealed, but only that when such laws are enacted, a society that cares about unemployment will need to consider the tradeoffs involved.

The natural rate of unemployment is the rate of unemployment that would be caused by the economic, social, and political forces in the economy even when the economy is not in a recession. These factors include the frictional unemployment that occurs when people are put out of work for a time by the shifts of a dynamic and changing economy and any laws concerning conditions of hiring and firing have the undesired side effect of discouraging job formation. They also include structural unemployment, which occurs when demand shifts permanently away from a certain type of job skill.

Video: GDP, Unemployment, Inflation

Answer the self check questions below to monitor your understanding of the concepts in this section.

Answer the self check questions below to monitor your understanding of the concepts in this section.Self Check Questions

- Define the term "unemployment."

- What is meant by the term "unemployment rate."

- Go online and research the current unemployment rate for the U.S. for the last 6 months, the last year, two years ago, and 5 years ago. Did the rate go up or down compared to today's current unemployment rate?

- Why is the unemployment rate not comprehensive? Give 2 examples.

- List and explain the 5 types of unemployment.

- Explain the concept of full employment.

- Use the internet to research which year the U.S. had full employment. When did it occur? Why did it occur?

- Why is consistent low unemployment difficult to maintain?