5.6: Banks and Financial Institutions

- Page ID

- 1724

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Banks and Financial Institutions

In the previous lessons, you learned that individuals decide to allocate portions of their income to current consumption and savings. Financial planners recommend that individuals save at least three months of expenses in a "liquid" (easily accessible and easily converted to cash) account. Most people establish checking accounts from which to pay bills and to make purchases. Savings and checking accounts are depository accounts. In addition, banks make loans to individuals and businesses. Many banks give free checking accounts to students. The bank expects that the young people will have earning power when they complete their education and hope to get consumer loyalty in return for the free checking.

Universal Generalizations

- Financial institutions serve both borrowers and savers.

- Banks are in business to make money.

- Financial institutions make it possible to save your money in a secure location.

- Financial institutions consider your credit score when lending money.

Guiding Questions

- In addition to the depository institutions, what non-depository institutions exist to serve as financial intermediaries?

- What types of accounts are offered to consumers? What are the costs associated with these accounts?

Video: Checking and Savings 101

Banking

It is important to develop a plan for our financial savings future, so that we can budget and balance our income and our expenditures. We must understand our various banking institutions and how they function. Investing early in life gives the nest egg time to grow. Insurance and other risk-management strategies protect against financial loss. Using credit has costs and benefits. All of this knowledge will help us become more informed decision makers in our economy.

Activity

Follow the directions below to complete the activity.

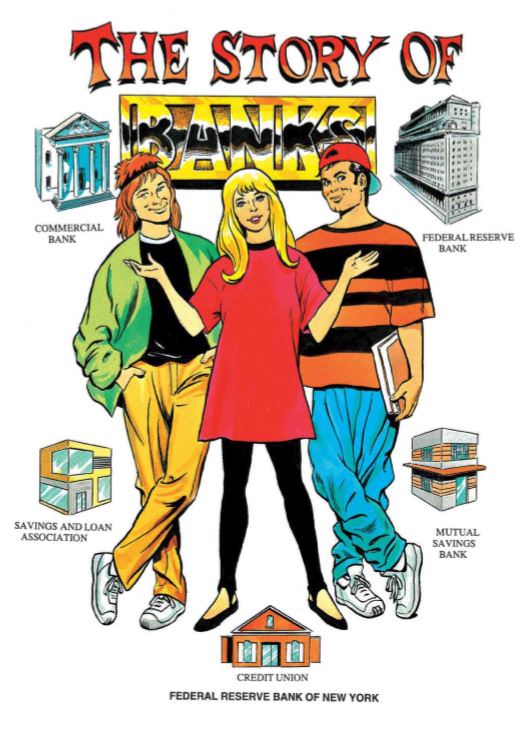

Follow the directions below to complete the activity.Read the comic titled "The Story of Banks." This comic is a .pdf file which can be downloaded by accessing the Unit 5 Resources. You will also find a Word .docx file of the assignment questions listed below the image. Complete and submit the assignment according to your teacher's instructions.

Activity - "The Story of Banks" - Questions

Answer the questions as you read and then submit your responses according to your teacher’s instructions.

- Why do individuals and business owners deposit their money in banks?

- What is a checking account and why do individuals need one?

- What is a money order and who might use these to pay bills?

- What do S and L’s (savings and loan banks) do?

- What is a credit union?

- What do you need to use a check for payment for goods and services?

- How does the store get the money?

- What is an overdraft?

- What are the penalties for writing bad checks?

- What is an ATM?

- What does the bank do with the money customers deposited?

- How much of the deposits can the bank lend?

- Explain the reserve requirement?

- Explain how banks create money by making loans? Give an example.

- Who insures consumer deposits in banks?

- What types of accounts pay interest?

- What documents does a business need to prepare to apply for a bank loan for expansion?

- What electronic services do banks provide?

Now apply what you learned.

- Compare three banks that have branches in your neighborhood. Which one offers the best program for your checking account needs? Compare services, fees, convenience, and reputation. Make up your criteria, chart them and explain your decision.

(Insert the names of the banks.)

| Criteria | Bank 1 | Bank 2 | Bank 3 |

| Fees | |||

| List your other criteria in this column. |

Now write a brief explanation explaining your decision on which bank would be best for your needs.

Follow the links below to Khan Academy to learn more about how banks work:

Banking 2: A bank's income statement

Banking 3: Fractional reserve banking

Banking 4: Multiplier effect and the money supply

Banking 5: Introduction to bank notes

Banking 6: Bank notes and checks

Decision Making and Planning for the Future

Individuals expect economists, government officials, and corporations to make good decisions concerning the economy. In the same manner, consumers need to make informed personal financial decisions. In this video, you will learn about how to use the PACED decision making process to evaluate economic decisions.

As a typical United States teenager, you are consuming some of the family disposable income. You may have income from a part-time job, doing odd jobs, or receiving an allowance. Statistics vary, but you may account for $1500 to $5000 worth of consumer spending annually. Estimates are that teens spend $1000 on the Prom.

"Teenagers are the hottest consumer demographic in America. At 33 million strong, they comprise the largest generation of teens America has ever seen--larger, even, than the much-ballyhooed Baby Boom generation. Last year, America's teens spent $100 billion, while influencing their parents' spending to the tune of another $50 billion." (Source: PBS Frontline "The Merchants of Cool")

Watch segment 1 of the The Merchants of Cool to understand why business targets teen consumers.

Merchants of Cool http://www.pbs.org/wgbh/pages/frontl...ows/cool/view/

Merchants of Cool http://www.pbs.org/wgbh/pages/frontl...ows/cool/view/- Now that you have watched the video, consider this question:

How much of your money do the "Merchants of Cool" and the merchants of the necessities like transportation get each week? Keep all receipts for every item (good or service) you purchase every day for seven days. If you put money in a vending machine or do not get a receipt for an item note the amount on a piece of paper or your smart phone.

- Tally your spending each day and also at the end of the week.

- Did the total surprise you?

- Will you make any changes in your spending for the next week?

- Could you save more money for your future?

- Would you manage your money more effectively if you used the PACED model?

Individuals need a budget just like banks, corporations, and government. Each individual or household makes decisions on what to do with disposable or after tax income. Fixed expenses take a portion. The rest will be allocated to spending on consumption or saving for the future.

Activity

Follow the instructions below to complete the activity.

Follow the instructions below to complete the activity.How much money will you need to earn in order to afford the lifestyle you want to have after graduating from college? Go to the Jumpstart Coalition and click on the "Enter Reality Check" button to calculate spending and the income you need. You are creating a budget in the process.

How much post high school education will you need to afford the lifestyle you selected? How will you pay for this education?

Answer the self check questions below to monitor your understanding of the concepts in this section.

Self Check Questions

- How can one make financial decisions for spending and saving in order to achieve future goals?

- How are banks and financial institutions important to individuals and to the economy?

- How should individuals evaluate risk and return in making investment decisions?

- What are the pros and cons of using credit?

- Why do people need insurance?

- What is the relationship between supply, demand, education, skills, and workers' earnings?

| Image | Reference | Attributions |

|

[Figure 2] | Credit: PBS Frontline Source: http://www.pbs.org/wgbh/pages/frontline/shows/cool/view/ License: CC BY-NC 3.0 |